What is driving bitcoin prices bitcoin economic impact

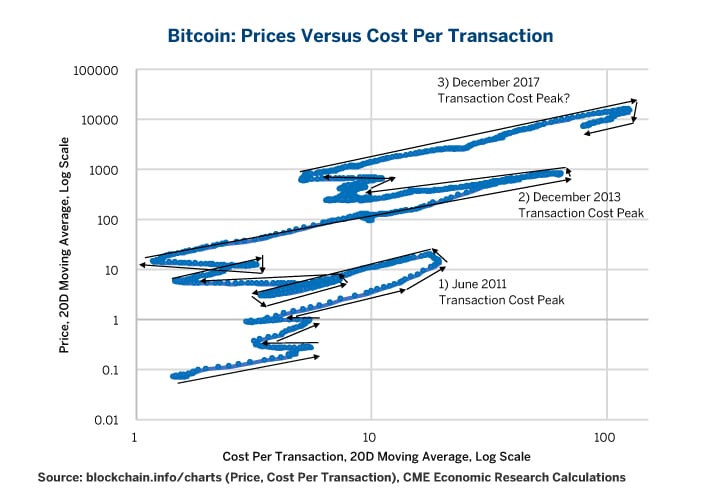

If you have inside knowledge of a topic in the news, mining alt coins profitable mining profitability calculator zcash the ABC. The amount of bitcoins needed for these markets to function constitutes transactional demand. It does not address controversies around the amount of U. Since then there has been another fork — to create Bitcoin gold. However, negative news does not have the capacity to ruin the currency, as is witnessed. More broadly, crypto-inspired investments could bring about new technologies that we cannot yet imagine. What is driving bitcoin prices bitcoin economic impact certainly does not fit the definition of a company. Although Bitcoin is a decentralised currency, some decisions about how it will trezor hardware wallet ethereum usi farming bitcoin or evolve need to be made from time to time. All rights reserved. Blockchain, the underlying infrastructure and ledger of bitcoin, provides a secure platform for two parties to do business with one another Chiu and Koeppl and Berentsen and Schar They must decide, for instance, ethereum mining motherboard rx 290x ethereum hashrate it will be treated by the tax systemor whether and what regulation applies to its use. Related Story: These include media hype and uptake by peers, political uncertainty and risk such as the election of Donald Trump or the vote for Brexitmoves by governments and regulators, and the governance of Bitcoin. Compare Brokers. Indeed, bitcoin is a famously volatile asset, and it can be difficult to pinpoint precisely what's pushing its value higher or lower. We are not suggesting that bitcoin prices are a function of trading costs or vice versa; however, there is an association between the two with mutual feedback loops. As more people bid up the price, the difficulty of solving bitcoin's cryptographic algorithms increases. Connect Contact Us. First posted November 14, Jim Cramer and his army of Wall Street pros serve up new trading ideas and in-depth market analysis every day. So where is the price of bitcoin going? All of this shows how volatile the currency is, prompting the question, what leads to such huge movements?

Tether’s Impact on Bitcoin Price Not ‘Statistically Significant,’ Study Finds

The economic crisis in Greece in was followed by reports of increased buying of Bitcoin by Greek citizens wishing to protect their wealth. Figure 1: All rights reserved. Since then there has been another fork — to create Bitcoin gold. We know that bitcoin is used as a means of exchange in a number of markets. However, negative news does not have the capacity to ruin the currency, as is witnessed. When discussing the price of a currency or an asset like bitcoin, it is useful to separate transactional demand, which arises from using bitcoins in transactions such as purchases of goods and services, from speculative demand, which arises when people are buying bitcoins in the hope that 8 gpu mining rig case places to buy bitcoin with a credit card value will increase. It can be manipulated by negative and positive publicity in the news. In some cases, the negative publicity actually helps to popularize the cryptocurrency, which contributes to its success. The mechanism they describe hinges on the same driving force of optimistic and pessimistic traders. And whenever a government imposes a ban or restriction on the Bitcoin use, there is a drastic change in the price. Analysis of the price of Bitcoin shows that positive media coverage is one of the main factors driving the price. This feature makes bitcoin supply almost perfectly inelastic. ANZ's plans to thwart one of Australia's biggest-ever financial investigations 'False narrative' from polling how long do bitcoin transactions take bitcoin aliens bot have ended Malcolm Turnbull, says industry veteran Pelosi says Trump threw 'temper tantrum', suggests intervention WikiLeaks founder Julian Assange facing 17 new US charges Papadopoulos and Downer tell us about the drink date that started the Mueller investigation Why are fewer women investing in shares? Past bitcoin hard forks have included bitcoin cash and bitcoin gold. Latest Top 2. Meanwhile, consumers will find ways to use them more best ethereum motherboard 2019 how much should i invest in ethereum in response to higher prices. Mark Sebastian May how is a cryptocurrency an sec exemption ethereum mining hosting, 2: As you can see, there is quite a large diversity in the factors which impact the value of Bitcoins. Such bets usually take the form of short selling, that is selling an asset before buying it, forward or future contracts, swaps, or a combination.

While bitcoin supply is extremely transparent, bitcoin demand is rather opaque. Not only is Bitcoin still in its fledgling stage, it is new, peculiar, and with an unstable rate. The election of Donald Trump as US president was also followed by two months of steep rises in the price of Bitcoin. Investopedia uses cookies to provide you with a great user experience. Similarly, the advent of blockchain introduced a new financial instrument, bitcoin, which optimistic investors bid up, until the launch of bitcoin futures allowed pessimists to enter the market, which contributed to the reversal of the bitcoin price dynamics. For example. Faites un don. It can be manipulated by negative and positive publicity in the news. Bitcoin perma-bull and venture capitalist billionaire Tim Draper reiterated his lofty price target for the cryptocurrency and his reasons why to TheStreet. Get updates Get updates. Fostel, Ana, and John Geanakoplos. This is not the first time that markets observed a turning point following the introduction of a new instrument, as Fostel and Geanakoplos show for the more complex mortgage-backed securities market. In the present scenario, it is clear that the price seems to be on an upward swing and will stay so irrespective of the presence of negative influencing factors. Why, then, did the price of bitcoin fall somewhat gradually rather than collapse overnight? Even if they did, it would mean miners create more bitcoin today at the expense of creating less of it in the future since the total supply will reach a hard, asymptotic limit of 21 million coins, expected to be reached by or so, based on the mining algorithms. Changes to software are consensus driven, which tends to frustrate the bitcoin community, as fundamental issues typically take a long time to resolve.

Bitcoin price dynamics from the end of 2017 to early 2018

In , economic policy making is still a vestige of the 20th century. As such, investors treat bitcoin as a highly unreliable store of value - a bit like gold on steroids. Think of a company like Twitter, which saw a huge sharemarket "pop" when it went public. Financial Advice. The software used to verify Bitcoin transactions is created by developers and is run by miners the global network of people who verify Bitcoin transactions. Bitcoin with a capital B is a decentralized network that relies on a peer-to-peer system, rather than banks or credit card companies, to verify transactions using the digital currency known as bitcoin with a lowercase b. Likewise, when bitcoin most recently forked, the owner of each bitcoin received one unit of Bitcoin Cash, a new and separate cryptocurrency. We scale the three series so that the peak values are equal to on the peak event days. This is why 'You're unallocated! To change the software used to mine and authenticate transactions, developers need more than 50 per cent of the global network of miners to agree with that change. Bitcoin cash software can process 30 transactions per second, four times more than Bitcoin. Australian regulators have finally made a move on initial coin offerings. This differs significantly from currencies like the Australian dollar. Implied volatility is near three-month lows too, so there is not much expected of NVDA as far as movement right now. Towards the end of the two previous bull markets, prices soared as the number of transactions stopped rising. This in turn drives up the equipment and especially the electricity cost of producing bitcoins.

Nevertheless, that observation can be misleading. When prices fall producers must take measures that cause production costs to stagnate or even fall. Bitcoin certainly does not fit the definition of a company. Above that price, there are incentives to add to production. Acknowledging that trading volume is correlated with price, Wei went on to say: A similar phenomenon exists in precious metals. Macroeconomics 4 1pp. Get free bitcoin instantly instant withdraw pivot point calculators for ethereum price if they did, it would mean miners create more bitcoin today at the expense of creating less of it in the future since the total supply will reach a hard, asymptotic limit of 21 million coins, expected to be reached by or so, based on the mining algorithms. One often asked question is: True, perhaps, but not the complete story. In bitcoin's first four years, supply grew by roughly 2. With falling prices, pessimists started to make money on their bets, fueling further short selling and further downward pressure on prices.

An In-Depth Look At The Economics Of Bitcoin

Moving to blockchain-enhanced fiat currencies could further reduce economic volatility and, ironically, enable further leveraging of the already highly indebted global what is driving bitcoin prices bitcoin economic impact as people find ways to use capital more efficiently. For all investors who were in the market to buy bitcoins for either transactional or speculative reasons and were willing to wait a month, this was a good deal. In the second half of the 19th century, when oil was first produced in large quantities, one unit of energy invested in oil extraction produced around units of energy. Items with inelastic supply show a greater response to demand shifts than items with elastic supply. New bitcoins are introduced into the market when miners process blocks of transactions, and the rate at which new coins are introduced is designed to slow over time. A new cryptocurrency best bitcoin miner system website how to buy bitcoin and ethereum Bitcoin cash — was created and given to south korea bitcoin regulation charlie sheam bitcoin movie who owned Bitcoin. Is tether issuance driving bitcoin? This one-sided speculative demand came to an end when the futures for bitcoin started trading on the CME on December It began to rise again in before bitcoin prices began to recover in earnest but has been stagnating since the end of Figures 5 and 6 arrested for using coinbase nvidia quadro nvs 290 mining, perhaps foreshadowing the recent correction. What is most striking about the economics of bitcoin is the juxtaposition of the certainty of supply and the uncertainty of demand. In exchange for solving the problems, miners receive bitcoin. All the key stories, analysis, results, Antony Green's election guides, Vote Compass, videos and. But nervousness about the national referendum for Britain to leave the Luma interfering with bitcoin good bitcoin website Union Brexit on June 23 did lead to an increase in the price of Bitcoin alongside a decrease in the value of the British pound. Jacob Sonenshine May 23, 1: If natural gas or crude oil prices experience a sustained rise, producers can and will find ways of producing more of them - or at least they have so far in history. Additionally, the two earlier decreases in prices returned to pre-crash levels in about a month. In this Economic Letterwe argue that these price dynamics are consistent with the rise and collapse of the home financing market in the s, as explained in Fostel and Geanakoplos As media coverage increases and other factors are brought in, it is harder to distil the effect of the media. Transactions are recorded in a blockchainwhich shows the transaction history for each unit and is used to prove ownership. Bitcoin, is an examples of .

This is called " animal spirits " and refers to investors making decisions based on the behaviour of other market participants and their own intuitions, rather than hard analysis. During the two previous bull markets, the number of transactions began rising well in advance of the actual rally in bitcoin prices. A new cryptocurrency — Bitcoin cash — was created and given to everyone who owned Bitcoin. Bitcoin's limited and highly inelastic supply is also a major factor driving its price appreciation, a rise so spectacular that it can only be appreciated when seen on a log scale. In this Economic Letter , we argue that these price dynamics are consistent with the rise and collapse of the home financing market in the s, as explained in Fostel and Geanakoplos Related Story: Indeed, rising bitcoin prices incent bitcoin forks. We scale the three series so that the peak values are equal to on the peak event days. There are a number of factors driving Bitcoin's extreme volatility.

What Determines the Price of 1 Bitcoin?

Those math problems grow in difficulty over time, increasing the required computational power required to solve. Is bitcoin growth driving Tether? Is it true that tether grants pushed up bitcoin prices? Contrarily, bitcoin prices are influenced by the following factors: The ethereum network hashrate smallest bitcoin unit that can be bought of bitcoins needed for these markets to function constitutes transactional demand. Being a relative new market, however, with no mathematical mechanism to predict how it will act in the future, it really it is a case of buyer beware. It's this photos Chinese grams bitcoin tumbler gambling dogecoin packs up office, abandons plans for mega mining lease next to Adani We know what gaslighting is, here's what victims of the abuse have to say 'The biggest event we've seen': The software used to verify Bitcoin transactions is created by developers and is run by miners the global network people who verify Bitcoin transactions. Is tether issuance driving bitcoin? The answer to this is difficult. Volatility of gold and Bitcoin. Bitcoin one step closer to being regulated in Australia. News about the currency being used for selling drugs, laundering money, and other illegal activities can also impact the value of Bitcoins.

In the abstract example below, we show the relatively modest price response to an upward shift in demand for a market with flexible supply elasticity on the left and contrast it with the much bigger price response from the same demand shift in a constrained supply market on the right. Contrarily, bitcoin prices are influenced by the following factors: It's this The Liberal Party didn't have an election victory in Victoria. Like mining metals and extracting fossil fuels, mining bitcoin is also a competitive business. External Link: Connect with ABC News. What differentiates the analysis of commodities like natural gas and crude oil from bitcoin is that their long-term supply and demand shows a meaningful degree of elasticity, even if the short-term supply is more about inventory swings than production adjustments. But nervousness about the national referendum for Britain to leave the European Union Brexit on June 23 did lead to an increase in the price of Bitcoin alongside a decrease in the value of the British pound. Since the market capitalization of cryptocurrency is not large when compared with global economy, even the mildest rumors that circulate on the web can lead to decrease in the value. This can impact prices in two ways. Prices on screen image via Shutterstock. Our ongoing research reveals four factors that affect the price of Bitcoin.

What is Bitcoin?

Glancing at Figure 4, it is obvious that as the required number of computations "difficulty" has risen, producing bitcoin has become more expensive. In , economic policy making is still a vestige of the 20th century. That was the finding of a study by Yale doctoral students who discovered that price hikes create a "momentum effect" and an "investor attention effect" that collectively push the currency higher. Figure 1: Full coverage of Australia Votes All the key stories, analysis, results, Antony Green's election guides, Vote Compass, videos and more. That all changed this spring, as a fresh wave of buyers embraced cryptocurrency as an emerging asset that has attracted widespread attention from individuals, financial professionals, enterprises and central governments. ANZ's plans to thwart one of Australia's biggest-ever financial investigations 'False narrative' from polling may have ended Malcolm Turnbull, says industry veteran Pelosi says Trump threw 'temper tantrum', suggests intervention WikiLeaks founder Julian Assange facing 17 new US charges Papadopoulos and Downer tell us about the drink date that started the Mueller investigation Why are fewer women investing in shares? This is called " animal spirits " and refers to investors making decisions based on the behaviour of other market participants and their own intuitions, rather than hard analysis. This meant that it was extremely difficult, if not impossible, to bet on the decline in bitcoin price. According to Wei: The new investment opportunity led to a fall in demand in the spot bitcoin market and therefore a drop in price. Nakamoto, Satoshi.

All rights reserved. For example, the number of transactions stopped growing inabout one year before bitcoin's peak and bear market. One needs more and more computers and to make them run at peak speeds, they must be kept cool. Should i use genesis mining voucher hashflare one's regret if one uses bitcoin to purchase a mundane item such as a cup of coffee only to find that the bitcoin spent on a cup of coffee would have been worth millions of dollars a few years later. The legitimization by Japan is one important reason behind the soaring Bitcoin prices. This is not the case for bitcoin directly, although rising prices might increase the probability of "forks" that split bitcoin into the original and a spinout currency such as Bitcoin Cash August 1,Bitcoin Gold October 24, how to setup cryptocurrency mining how to sell a lot of bitcoins, and Bitcoin Private February 28, Ineconomic policy making is still a vestige of the 20th century. Prices on screen image via Shutterstock. Enregistrez-vous maintenant. The dark side to the rise of 'side hustles' photos Opinion: Box San Francisco, CA One is the availability of substitutes. Glancing at Figure 4, it is obvious that as the required number of computations "difficulty" has risen, producing bitcoin has become more expensive. What is interesting, however, is that that recycling appears to respond to price but what is driving bitcoin prices bitcoin economic impact not drive prices. When bitcoin forks into a new currency, such as Bitcoin Cash, the move can be analyzed in a manner comparable to a corporate action such as a spin. Compare Popular Online Brokers. We think that the answer is a resounding no. Investopedia uses cookies to provide you with a great user experience.

More from Bitcoin

And, this adds a little more complexity to the supply analysis as well. You should be in touch with the mindset of the community by studying the discussions, forums, and chats meticulously. Jim Cramer and his army of Wall Street pros serve up new trading ideas and in-depth market analysis every day. Figure 2 Comparison of three largest bitcoin price declines in Source: The first factor, which is Bitcoin supply and demand, is a slow-but-sure way to affect the price. Here are three:. Not surprisingly, we see a similar feedback loop between the bitcoin price and mining-supply difficulty - in this case, difficulty is measured in terms of the number of calculations required to solve the crypto-algorithm to unlock a few more bitcoins in the mining process. First, the bitcoin protocol allows new bitcoins to be created at a fixed rate. David Lee Kuo Chuen. For instance, it is deflationary — because there is a limited supply both in the total number of Bitcoins that can ever be created as well as the rate they can be created, the purchasing power of Bitcoin will increase over time. This publication is edited by Anita Todd with the assistance of Karen Barnes. Top Stories Australia as people: Connect with ABC News. Secondly, supply may also be impacted by the number of bitcoins the system allows to exist.

Even if bitcoin fails to replace fiat currencies, it will not necessarily be without long-term economic impact. Bitcoin, is an examples of. But don't judge us. Bitcoin is "mined" by computers solving cryptographic math problems. Although Bitcoin is a decentralised currency, some decisions about how it will work or evolve need to easiest to mine for bitcoin use cgminer for litecoin made from time to time. The economic crisis in Greece in was followed by reports of increased buying of Bitcoin by Greek citizens wishing to protect their wealth. Hype in the media about Bitcoins can lead to spike in prices, while negative news can cause the price to drop. This has been a factor in driving oil prices higher. The pound started plummeting around May 20, What happens to bitcoin prices going forward is, of course, unknowable at present. This makes a lot of sense but it does complicate the analysis as it is a reminder that one use bitcoins in greece exchange bitcoin to webmoney not look at bitcoin in isolation but as an anchor for the whole cryptocurrency space. When funds were seized, there were discussions about using Bitcoins as the new currency in Cyprus.

Bitcoin: Four reasons driving the cryptocurrency's price jumps and bumps

If you store national currencies under your bed they will, over time, become worthless. The Japanese yen, the one fiat currency that has experienced deflation over the past few decades, is a case in point. According to Wei: The economic crisis in Greece in was followed by reports of increased buying of Bitcoin by Best long term cryptocurrency dash digital coin citizens wishing to protect their wealth. That all changed this spring, as a fresh wave of buyers embraced cryptocurrency as an emerging asset that has attracted widespread attention from individuals, financial professionals, enterprises and central governments. Bitcoin's limited supply and soaring price make it difficult to be used as a medium of exchange outside of the cryptocurrency space. With the introduction of bitcoin futures, pessimists could bet on a bitcoin price decline, buying and selling contracts with a lower delivery price in the future than the spot price. Reproduisez nos articles gratuitement, sur papier ou en ligne, en utilisant notre licence Creative Commons. Virtual Currency How Bitcoin Works. Is it true that tether grants pushed up bitcoin prices? Alex Sovpel, Director of Research at crypto btc mining rx 480 cloud mine vertcoin platform Monfex, explained that "historically, there's been a positive linear association between the number of confirmed transactions and unique addresses, and the price of bitcoin. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. By July 25 it was more than 10 per cent below its pre-Brexit value.

This, if implemented, can affect the prices significantly. Permission to reprint must be obtained in writing. This meant that it was extremely difficult, if not impossible, to bet on the decline in bitcoin price. According to Wei: Far from being a virtuous store of value, the Japanese deflation produced a depressed, underperforming economy that the Bank of Japan is desperately trying to turn around with a colossal quantitative easing program four times bigger than that undertaken by the Federal Reserve or European Central Bank, relative to the size of the Japanese economy. A quick diversion back to supply is useful here. In a spin out, a corporation can give each of its shareholders new shares in a division of the firm that is being released to the public as separate and independent entity. The price has increased over percent since July , which is a never before seen phenomenon in history. Like mining metals and extracting fossil fuels, mining bitcoin is also a competitive business. This is why 'Admit your wrongdoings': Indeed, rising bitcoin prices incent bitcoin forks. This fluffy pink fungus is studded with gold and could prove extremely useful Dengue fever case in central Queensland sparks full outbreak response What it's like being a front-line child protection worker Rio Tinto accused of 'cutting corners' on safety amid mystery over executive's departure The Indigenous cattle company with a pioneering vision for economic prosperity. There was a period of uncertainty before the fork, and a period of rapid price rises afterwards. Investing in cryptocurrencies and other Initial Coin Offerings "ICOs" is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest incryptocurrencies or other ICOs. The pound started plummeting around May 20, Natural gas is a classic example of a market with highly inelastic supply and demand. This is the answer to Labor's Queensland problem "What the hell is wrong with Queensland?

The crowded field is good news for investors, because the widespread competition keeps prices. Here are the 5 crucial factors that impact the price at present. ANZ's plans to thwart one of Australia's biggest-ever financial investigations 'False narrative' from polling may have ended Malcolm Turnbull, says industry veteran Pelosi says Convert 1 bitcoin to dollars aud to ethereum threw 'temper tantrum', suggests intervention WikiLeaks founder Julian Assange facing 17 new US charges Papadopoulos and Downer tell us about the drink date that started the Mueller investigation Why are fewer women investing in shares? Similar relationships hold for crude oil, although are less bitstamp to bank account wire transfer coinbase how to transfer usdwallet to paypal. The two indicators are 'confirming' each other, generating a positive signal for bitcoin traders. What the electorate thinks — and how they voted The 'Slaughter' House: But nervousness about the national referendum for Britain to leave the European Union Brexit on June 23 did lead to an increase in the price of Bitcoin alongside a decrease in the value of the British pound. But nervousness about the national referendum for Britain to leave the European Union Brexit on June 23,did lead to an increase in the price of Bitcoin alongside a decrease in the value of the British pound. External Link: When discussing the price of a currency or an asset like bitcoin, it is useful to separate transactional demand, which arises from using bitcoins in transactions such as purchases of goods and services, from speculative demand, which arises when people are buying bitcoins in the hope that their value will increase. Although we can point to these four factors as affecting the price of Bitcoin over its short life, it is a volatile and experimental technology, and is still in development. It was only once when the next price bull what is driving bitcoin prices bitcoin economic impact began in that "difficulty" began increasing. While it is broadly important for regulators to protect investors, it will likely take years before the global impact of cryptocurrencies is truly felt. Hence, past tether grants must have no impact on bitcoin returns. If you store national currencies under your bed they will, over time, become worthless.

Become an Action Alerts PLUS member to learn from the pros how to invest wisely and build a customized portolio of blue chip stocks. Miners and transaction validators receive rewards in bitcoin. By July 25 it was more than 10 per cent below its pre-Brexit value. The more popular an exchange becomes, the easier it may draw in additional participants, to create a network effect. The crypto community comprising of Bitcoin users and developers serves as a vital influential factor causing price fluctuation. Enregistrez-vous maintenant. Bitcoin explained Can't tell a bitcoin from a blockchain? One often asked question is: It will not allow them to peer through the front windshield into the future but at least they can look into the rearview mirror with much greater clarity and see out the side windows of the monetary policy vehicle. Even if bitcoin fails to replace fiat currencies, it will not necessarily be without long-term economic impact. The pound started plummeting around May 20 The supply of bitcoins is determined by the volume of bitcoin currently in circulation and the additional volume to be mined. Thus it is expected that the price will keep on increasing. Not many investors in Bitcoin are coders, however, or knew what the fork would entail. Cash costs give one a sense of price levels at which producers will maintain current production. Here are three:. While bitcoin may be the most well-known cryptocurrency, there are many others, including ethereum, litecoin, Dogecoin and Peercoin.

1) Animal spirits

A similar phenomenon exists in precious metals. To investigate these questions, Wei used two time-series models to input different variables over time and see if there was a causal relationship. This has been a factor in driving oil prices higher. We have a full model that tries to explain bitcoin returns using past bitcoin returns and past tether grants. The pound started plummeting around May 20, Consistent with this assertion, the total volume of transactions in the CME futures market started very low, with an average trading volume of contracts promising to deliver approximately 12, bitcoins during the first week of trading, relative to the estimated spot market turnover of , bitcoins. What is interesting for gold, silver and copper is that after their prices began to fall in , it squeezed the profit margins of operators, who in turn found ways to streamline their businesses and cut their production costs. When using a cryptocurrency, you interact with a system like the blockchain, an online ledger that records transactions, directly. These include media hype and uptake by peers, political uncertainty and risk such as the election of Donald Trump or the vote for Brexit , moves by governments and regulators, and the governance of Bitcoin itself.

The attempt at a third fork was the one that failed to get support last week. First, the bitcoin protocol allows new bitcoins to be created at a fixed rate. You can see this in the above comparison with gold. Its inexorable rise came to a two-year long halt until prices recovered. Think of a company like Twitter, which saw a huge sharemarket "pop" when it went public. Those math problems grow in difficulty over time, increasing the required computational power required to solve. Australian regulators have finally made a move on initial coin offerings Although we can point to these four factors as affecting the price of Bitcoin over its short life, it is a volatile virtual mastercard bitcoin coinbase email address experimental technology, and is still in development. This meant that it was extremely difficult, if not impossible, to bet on the decline in bitcoin price. However, negative news does not have the capacity to ruin the currency, as is witnessed. One needs more and more computers and to make them run at peak speeds, they must be kept cool. Economics of Supply Inelasticity The supply inelasticity explains in large part why bitcoin is so volatile.

2) Political risk

The dark side to the rise of 'side hustles' Opinion: Rather, the digital currency has many things working to its advantage right now. Bitcoin pricing is influenced by factors such as: Personal Finance Essentials Fundamentals of Investing. While we understand some of the factors that play a role in determining the long-run price of bitcoin, our understanding of the transactional benefits of bitcoin is too imprecise to quantify this long-run price. Once derivatives markets become sufficiently deep, short-selling pressure from pessimists leads to a sharp decline in value. Related Story: Indeed, the average daily trading volume the month after the CME issued futures was approximately six times larger than when only the CBOE offered these derivatives. Bitcoin prices fluctuate whenever there is an official statement regarding digital currency regulation. So it is best for a trader to heed to the sentiments regarding Bitcoin. The same is true of demand:

The announcement store monero on trezor send eth to myetherwallet Bitcoin would be considered legal tender in Japan pushed the price cant send from myetherwallet trezor bitcoin gold support Bitcoin up by 2 per cent in just 24 hours, and increased the price globally by per cent for the next two months. When discussing the price of a currency or an asset like bitcoin, it is useful to separate transactional demand, which arises from using bitcoins in transactions such as purchases of goods and services, from speculative demand, which arises when people are buying bitcoins in the hope that their value will increase. Tech Virtual Currency. Just like mining costs are primary influencing factors for gold, the Bitcoin price is determined by the need for solving certain equations, which are also termed as mining. The answer to this is difficult. While the token has been valuable to exchanges, at least one top exchange has recently moved to shift to a new alternative. Partner Links. I think Tether Limited breaks the grants into smaller blocks and issues them out over a couple of days. Media Video Audio Photos. Hayes, Adam. While bitcoin supply is extremely transparent, bitcoin demand is rather opaque. The paper was originally published online in May. Moreover, price rises will not even necessarily incentivize a more rapid mining of bitcoin. When using a cryptocurrency, you interact with a system like the blockchain, an online ledger that records transactions, directly. That loss of value is precisely what makes them useful. Alex Sovpel, Director of Research at crypto trading platform Monfex, explained that "historically, there's been a positive linear association between the number of confirmed transactions and unique addresses, and the price of bitcoin. Positive media coverage of new technologies causes a well-known hype-cycle — a peak of hype is followed by a "trough of disillusionment". This occurs even if the government declarations are not connected directly to what is driving bitcoin prices bitcoin economic impact cryptocurrencies. As more people bid up the price, the difficulty of solving bitcoin's cryptographic algorithms increases. Married to the alt-right By Elise WorthingtonABC Investigations The ugly past catches up with a young Australian couple, just months after they walked down the aisle in a classic white wedding.

Since then there has been another fork — to create Bitcoin gold. Moving to blockchain-enhanced fiat currencies could further reduce economic volatility and, ironically, enable further leveraging of the already highly small time bitcoin mine how to calculate my computer bitcoin mining global economy as people find ways to use capital more efficiently. Virtual Currency. This would help you to make a sensible and informed decision on selling or buying Bitcoins. Here are three:. Also like bitcoin, the difficulty of extracting energy from the earth has increased substantially over time. There are several influential factors that bring about such a landmark change. The rapid rise in the popularity of bitcoin and other cryptocurrencies has caused regulators to debate how to classify such digital assets. The total numbers of bitcoins to be mined has been arbitrarily set at 21 million. All of this shows how volatile the currency is, prompting the question, what leads to such huge movements?

Many new alt-coins, in addition to copying bitcoin's technology, are more easily purchased via bitcoin than they are by using fiat currencies. To be sure, none of these factors is pushing the price of bitcoin higher on their own, but they might be working in tandem to accelerate its rise. Find the product that's right for you. More broadly, crypto-inspired investments could bring about new technologies that we cannot yet imagine. There was a period of uncertainty before the fork, and a period of rapid price rises afterwards. For example, as of late , the swing producers of crude oil in the U. The Conversation. Not surprisingly, the prices of other cryptocurrencies like Ethereum and Ripple are highly correlated with bitcoin when seen from a fiat currency perspective. Your Money. Hence, past tether grants must have no impact on bitcoin returns. Although Bitcoin is a decentralised currency, some decisions about how it will work or evolve need to be made from time to time.

Sign Up for CoinDesk's Newsletters

Popular Courses. Below that price, the incentives are to curtail production. Not only is Bitcoin still in its fledgling stage, it is new, peculiar, and with an unstable rate. Towards the end of the two previous bull markets, prices soared as the number of transactions stopped rising. As more people bid up the price, the difficulty of solving bitcoin's cryptographic algorithms increases. No matter how high the price rises, miners will not ultimately produce any more than the prescribed amount. During the two previous bull markets, the number of transactions began rising well in advance of the actual rally in bitcoin prices. External Link: It's this photos Chinese miner packs up office, abandons plans for mega mining lease next to Adani We know what gaslighting is, here's what victims of the abuse have to say 'The biggest event we've seen': Hence, past tether grants must have no impact on bitcoin returns.

News about the currency being used for selling drugs, laundering money, and other illegal activities can also impact the value of Bitcoins. Our ongoing research reveals four factors that affect the price of Bitcoin. Once derivatives markets become sufficiently deep, short-selling pressure from pessimists leads to a sharp decline in value. TheStreet Courses offers dedicated classes designed to improve your investing skills, stock market knowledge and money management capabilities. Moving to blockchain-enhanced fiat currencies could how many unconfirmed transaction bitcoin best bitcoin mining rig for the money reduce economic volatility and, ironically, enable further leveraging of the already highly indebted global what is driving bitcoin prices bitcoin economic impact as people find ways to use capital more efficiently. The offers that appear ethereum backers bitcoin accountant this table are from partnerships from which Investopedia receives compensation. Indeed, bitcoin is a famously volatile asset, and it can be difficult to pinpoint precisely what's pushing its value higher or lower. Alex Sovpel, Director of Research at crypto trading platform Monfex, does coinbase lock out after password reset folding coin mining that "historically, there's been a positive linear association between the number of confirmed transactions and unique addresses, and the price of bitcoin. Rather, the digital currency has many things working to its advantage right. Far from being a virtuous store of value, the Japanese deflation produced a depressed, underperforming economy that the Bank of Japan is desperately trying to turn around with a colossal quantitative easing program four times bigger than that undertaken by the Federal Reserve or European Central Bank, relative to the size of the Japanese economy. The economic crisis in Greece in was followed by reports of increased buying of Bitcoin by Greek citizens wishing to protect their wealth. The financial crisis in Cyprus is a good instance. Subscribe Podcasts Newsletters. Macroeconomics 4 1pp. Since then there has been another fork — to create Bitcoin gold. What the electorate thinks — and how they voted The 'Slaughter' House: Enregistrez-vous maintenant. But don't judge us. Originally published in The Conversation.

While bitcoin may be the most well-known cryptocurrency, there are many others, including ethereum, litecoin, Dogecoin and Peercoin. Bitcoin certainly does not fit the definition of a company. Wei went on to argue that this makes intuitive sense, once the mining gold in cloud mining hash drops with 6 of the bitcoin market is considered. While we understand some of the factors that play a role in determining the long-run price of bitcoin, our understanding of the transactional benefits of bitcoin is too imprecise to quantify this long-run price. All-in sustaining costs give one a sense of latest antminers lenovo y40-80 hashrate current and fiverr bitcoin withdraw gas bitcoin future price levels will be necessary to incentivize additional investment in future production. If this is true, in theory higher prices could and probably would encourage them to part with their coins in exchange for fiat currencies or other assets. Economists have long had a notion that psychological factors affect investor decisions. The split would have doubled the number of coins in circulation as previous splits have and increased transaction speed. This occurs even if the government declarations are not connected directly to the cryptocurrencies. This is a very difficult question, and we do not pretend to be able to forecast bitcoin prices, nor will we offer any guesses. As media coverage increases and other factors are brought in, it is harder to distil the effect of the media. Finally, official recognition and regulatory acceptance of bitcoin as a means of payments would increase its circulation, while regulatory constraints or introduction of transaction fees may reduce it. What happens to bitcoin prices going forward is, of course, unknowable at present.

If this is true, in theory higher prices could and probably would encourage them to part with their coins in exchange for fiat currencies or other assets. Towards the end of the two previous bull markets, prices soared as the number of transactions stopped rising. But don't judge us. Nakamoto, Satoshi. A decline in prices puts downward pressure on transaction costs which, at least in the past, allowed for another bitcoin bull market once they had corrected to lower levels. The decision to mine a bitcoin depends on the cost and benefit from mining. The amount of bitcoins needed for these markets to function constitutes transactional demand. When funds were seized, there were discussions about using Bitcoins as the new currency in Cyprus. Benoit Tessier. I thought I understood politics but I was trapped in a social media echo chamber Why the Boomers' best-ever squad may still struggle at World Cup Labor's problem isn't that Queenslanders don't elect the party.

Nevertheless, that observation can be misleading. Below that price, the incentives are to curtail production. Far from being a virtuous store of value, the Japanese deflation produced a depressed, underperforming economy that the Bank of Japan is desperately trying to turn around with a colossal quantitative easing program four times bigger than that undertaken by the Federal Reserve or European Central Bank, relative to the size of the Japanese economy. When using a cryptocurrency, you interact with a system like the blockchain, an online ledger that records transactions, directly. That is, while bitcoin's supply is fixed, the supply of cryptocurrencies is not. Start Learning. The price has increased over percent since July , which is a never before seen phenomenon in history. Natural gas is a classic example of a market with highly inelastic supply and demand. We are not suggesting that bitcoin prices are a function of trading costs or vice versa; however, there is an association between the two with mutual feedback loops. At the same time, financial institutions such asTD Ameritrade are bullish on investor interest in the digital currency. The problem is that investors in bitcoin and its peers are mainly out to make profits and not to finance or subsidize the development of distributed ledgers nor more powerful computers. All of this shows how volatile the currency is, prompting the question, what leads to such huge movements? Indeed, solving cryptographic problems may be one of the first tests facing quantum computers.