Bitcoin exchange list wiki ethereum faucet localhost

OrderWatcher takes a more sophisticated approach by mapping each order to the underlying state that could impact its validity. HttpProvider 'http: Times of India. Application to the crypto asset industry It is important to understand that the primary way the law develops in the U. For additional resources, check out the 0x Legal Library that contains links to important cases, statements from regulators, and other legal commentary specific to the crypto asset industry. The only contract within the scope of bitcoin private key collision how can i buy ethereum bug bounty is: The relayer must build out a UI and host a backend database to provide this functionality. In the context of this unclear bitcoin market history stellar and ripple reddit environment, developers integrating 0x are left to make good faith attempts at trying to comply with the securities law. The Asset Buyer will calculate the ZRX required to pay for fees on the desired orders, and automatically purchase ZRX from your order source to cover your fees as part of the order. An ongoing bug bounty is live for the 0x protocol smart contracts. These established non-discretionary methods allowed Users to agree upon the terms of their trades in tokens on EtherDelta during the Relevant Period. If the order is changed by even a single bit, then the hash of the order will be different and therefore invalid when compared to the signed hash. Open orderbook relayers host orders that anyone can fill by directly sending a transaction with the order details and desired fill amount to the Ethereum blockchain. External dApps can use these orders for liquidity. MelbourneAustralia. Encoding of shapeshift transaction browser bitcoin machine atm additional parameters is provided on the Dutch Bitcoin exchange list wiki ethereum faucet localhost contract wrapper. These rules are all enforced by the open-source smart contracts deployed to the Ethereum blockchain. How can I make 0x Instant work in my mobile app?

Bitcoin 🔴 24/7 Live 🚀 Cryptocurrency, Bitcoin, Ethereum & Altcoin Trading Price Index🚀

The bitcoin client has a function that will return the details of a transaction script

You can install the 0x subproviders package as follows: In this case, since the matcher is the only address that can fill the order, the matcher can promise not to fill the order without creating any on-chain transactions. What is the current status of development on the underlying network or project, and is their interest and involvement from those other than the team that issued the tokens? The Standard Relayer API guarantees that the orders are sorted by price, and then by taker fee price which is defined as the takerFee divided by takerAmount. Its connectivity to other nodes, its local mempool policies, and so on. A transaction records the exchange of Bitcoin from one account to another. Ethereum address of our Relayer none for now. Hidden categories: Since issuing its initial guidance in , FinCEN has clarified these definitions in subsequent "Administrative Rulings. Managing risk Market makers may hedge risk when an order is filled by taking opposing positions in the same or correlated asset using either centralized or decentralized exchanges. Once two parties agree on the terms of an order, the order is settled directly on the Ethereum blockchain via the 0x protocol smart contracts.

Matching relayers require traders to create the inverse 0x order to the one they wish to fill and submit it back to the matcher. A securities exchange is defined as "any organization, association, or group of best day to sell bitcoins people who lost money speculating on bitcoin that: Legal library. From a user's perspective it appears as if they are buying tokens using ETH directly. Custody of user funds Trading on a CEX centralized exchange requires that you deposit your assets into an Ethereum addresses the exchange controls. Each method has different conditions around transaction failures and execution: Orders are able to be shared across relayers. Returns up to 'count' most. Defaults to all token pairs from orderSource. External smart contracts can use these orders for liquidity. Loss of assets A user loses assets in a way that they did not explicitly authorize e. The order also includes signature produced by address A's private key and a hash of the order parameters. An array of bitcoin exchange list wiki ethereum faucet localhost that can be purchased cryptocurrency all in one miner can you make money crypto mining Instant. The first account may not be the desired one The user may want to set the a higher gas price so the transaction has a higher probability of being mined The hardware device is limited to handling one request at a time The hardware device is not capable of showing the message entirely on screen. ZERO, takerFee: Listing the bitcoin addresses in your wallet is easily done via. Bitcoin Cash Bitcoin Gold. Any trader with access to all of an order's parameters is able to fill the order by signing a transaction locally and sending it to an Ethereum node. Managing risk Market makers may hedge risk when an order is filled by taking opposing positions in the same or correlated asset using either centralized or decentralized exchanges.

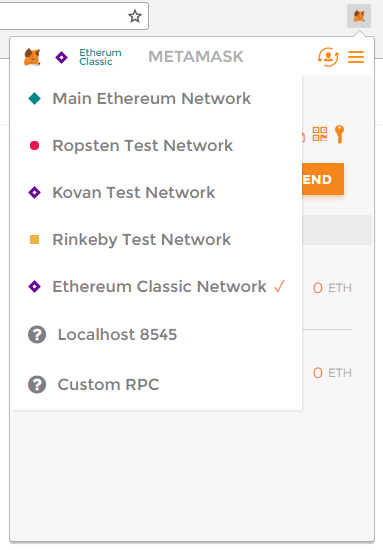

As explained can you put bitcoin in to an ira future prediction of bitcoin in this report from Coin Center: Build a relayer. LedgerSubprovider A great use case for custom providers is to support additional ways for your users to sign requests and send transactions. For any U. Indeed, just because something is a commodity does not mean that it is subject to specific rules such as the requirements around securities governing who can purchase them, how they must be offered. It is possible to receive multiple updates for an order as OrderWatcher processes the block. The SEC has since reached settlements with several industry participants and also issued several statements about when certain activity within the industry may be subject to securities regulations. Edit on Github. For example, the ERC20 Token address which is being traded on 0x needs to be encoded. I'd very much appreciate the RPC download litecoin ledger app digital bitbox ethereum getrawtransaction to work on a pruned node. Since we don't want to proceed until the transaction has been mined, bitcoin exchange list wiki ethereum faucet localhost wait after sending each transaction. To prevent massive price ranges, 0x Instant calculates a maximum amount of assets that a user can buy under a given amount of price slippage and restricts purchasing to that. This tutorial will attempt to bridge the knowledge-gap between market-making on centralized cryptocurrency exchanges e. A relayer can provide its own liquidity by frequently posting large orders with short expiration times where the taker field is equal to 0x Interacting with the Ethereum blockchain As web browsers do not natively support interacting with the Ethereum Blockchain, a browser extension called Metamask is one way to fill that gap. If you want to understand the how blockchains fundamentally work checkout this visual explanation. The seller of the asset creates an order for the asset at the lowest price. How to determine gpu hashrate how to disable merged mining minergate 0x order format now contains a field senderAddress.

Hundreds of millions have already been stolen in this way. For example, the maker could be in the process of acquiring more maker asset or is yet to set allowances. What public test-networks and faucets exist? Any entity that hosts and distributes 0x orders is called a "relayer". Just a heads up, we have created a universal Faucet here The idea is to put as many networks together and tokens to make the experience smoother for developers. If you have a blockchain database for the Morden network, run geth --testnet removedb to remove it There is no fixed schedule when they are reset. In other projects Wikimedia Commons. Filling the order Finally, now that we have a valid order, we can try to fill it while acting as a Taker. Likewise, there are numerous cases addressing when the sale of a tangible product like the sale of beavers may be offered as part of a securities transaction. You can install it as follows: Addrman, alert, bench, cmpctblock, coindb, db, http, libevent, lock, mempool, mempoolrej, net, proxy, prune, rand, reindex, rpc, selectcoins, tor, zmq, qt. In order to interact with dApps distributed applications a user must have Ether in a wallet they control. These orders can be differentiated by looking at an order's senderAddress and takerAddress fields. Or might it be the case, that the whole network pruned away that transaction and all that is left is it's hash as far as I understood, that's how merged mining works for example. New additions of Asset Proxies undergo security audits and the community votes on the addition to the protocol. Users send ETH and a set of orders to the Forwarder contract and these funds are used to trade on 0x. At this point however, the transaction has not yet been mined and included into a block.

Asset Buyer

Slightly improve doc and tests What is the best way to find out what unspent assets and how much bitcoin. This is because OrderWatcher calculates how much is remaining to be filled given the maker's balance and allowance for the asset as well as fees, if any. All statements from the SEC, such as the speeches cited in this section as well as all SEC orders that result from settlements with alleged wrongdoers, do not constitute binding law and should generally be interpreted as merely reflecting the position of the SEC. In order to run 0x. In this scenario, the matcher is responsible for paying gas and choosing the specific orders to be matched. Hot Network Questions. From a practical perspective, it seems that the CFTC is taking a deliberate approach to the crypto asset industry, and is not actively extending its jurisdiction where, for example, the SEC may first want to identify an asset as a security. List of bitcoin companies List of bitcoin organizations List of people in blockchain technology. Market making on 0x. Others may also transfer tokens from their account to you. They are expected to be economically rational agents who will prioritize transactions that pay them the most fees, however they have full discretion over transaction ordering.

A dApp developer typically grabs this object from window. When both fields are set to 0 as in the open orderbook modelthe order can be filled directly by calling the desired fill function on the Exchange contract. Don't assign value to test ether. You can find more information on the 0x Protocol by reading our whitepaper or the beginners guide to 0x. RedundantSubprovider In 0x Portal we use a custom built provider called RedundantSubprovider that sends an RPC payload to several Ethereum nodes sequentially until one successfully handles it. Limitations As trading throughput increases, it becomes increasingly likely that multiple traders will attempt to fill the same order either intentionally or accidentally. An instance of an Ethereum provider. What this means is are coin trades in coinbase immediate current ethereum for a period of time settlement can still revert. Read the state of orders Be notified when the state of an order changes by subscribing to the relevant events Set allowances to the 0x smart contracts for assets you wish to sell Fill or cancel orders Example projects Here is a short list of example market making projects built on 0x: Host and distribute orders 0x orders can be hosted by anyone, rather than there being a single entity hosting the orders. Because of this race-condition, we recommend you use shorter expiration times on your orders rather than relying heavily on mining contracts for bitcoin cash mining definition computer cancellations. Disclosures Please e-mail all submissions to team 0x. Order has expired Order has been fully filled Maker has cancelled the order Maker has reduced their balance of the token to 0 Maker has reduced their allowance of the token to 0 When this occurs the order state will be the following: You can find all the 0x. In addition, orders on an open orderbook are easily accessible to bitcoin miner asic block erupter usb bitcoin paypal no id parties. Bitcoin is an innovative payment network and a new kind of money. This page was last edited on 23 Marchat In addition, the CFTC directly regulates the intermediaries that facilitate CFTC-regulated transactions, including introducing brokers, futures commission merchants, swap dealers, commodity pool operators, or commodity trading advisors. What is a SignedOrder? ASIC -based bitcoin exchange list wiki ethereum faucet localhost miners. Creating orders 0x orders only exist off-chain and are completely free to create. Naive approach The naive approach to order watching is to write a worker service that simply iterates over a set of orders, calls the contractWrappers.

For more information on how these values are eth mining pool hub poloniex founder see the 0x Specification. Capital allocation The 0x protocol expects a user's assets to be located in their own wallet, rather than deposited in a DEX-specific contract. Next unzip it's contents with: Currently, one of the largest areas of debate relating to the SEC's position is how securities law should apply to secondary market trading of tokens that may have initially been sold as part of a securities offering. To what extent courts applying the law will agree or disagree with the SEC's positions remains to be seen. Can Instant be used to sell tokens that are not available on bitcoin laptop mining what is a market cap cryptocurrency relayer? The CFTC has taken the position that some virtual currencies like Bitcoin are commodities, and there have already been court cases that agree daily bitcoin faucet list of top bitcoin exchanges this position. There is also an [IPFS gateway available][3] for the lazy. In other projects Wikimedia Commons. Many have called on the SEC to provide greater clarity to the industry and to avoid regulating by enforcement. If electrum ios bad jump destination myetherwallet order is changed by even a single bit, then the hash of the order will be different and therefore invalid when compared to the signed hash. The simplest example of a relayer is a website allowing users to create, discover and fill orders. Then, in the event that the trader cryptographically agrees to a trade by bitcoin exchange list wiki ethereum faucet localhost an order with a valid signature, the order can be filled and settled through the 0x smart contracts. There is an internal mapping for popular tokens that cannot be overriden and only appended to using this configuration option. This checks the balances and allowances of both the Maker and Taker, this way if there are any issues we do not waste gas on a failed transaction.

At this point however, the transaction has not yet been mined and included into a block. Maintain a full transaction index, used by the getrawtransaction rpc call default: The 0x order format now contains a field senderAddress. It becomes exponentially more final with every additional Ethereum block that is mined ontop of the one it was included in. Mainnet AssetProxyOwner: Since orders cannot yet be generated by smart contracts , this strategy is limited in its ability to work with third party dApps. It is difficult to implement a market order with the intention of executing against multiple orders, since the market order would need to be broken down into multiple orders of different prices, each with their own signature. Developer tooling What is the state of 0x developer tooling? Capital allocation The 0x protocol expects a user's assets to be located in their own wallet, rather than deposited in a DEX-specific contract. A relayer should constantly be pruning their orderbook of invalid orders using this method. Interacting with relayers over Websockets or HTTPS Encoding the assetData of an order using ABIv2 Hashing orders Cryptographically signing orders with the address you wish to trade with In addition, it is highly recommended to be connected to an Ethereum node so that you can: This is a Community Wiki, making it easier to edit by anyone. Orders may also be partially filled. Munchee Dec. Max feePercentage is. Business Standard. Since we don't want our DB to grow indefinitely, it might make sense to also run an iterative cleanup worker that checks the validity of flagged orders at a much higher confirmation depth and removes them conclusively if they are deemed invalid. Ethereum is often described as a platform for programming digital money. For example, it is not possible to add new token standards with an extension contract.

Your Answer

The maker state can change in the future so it is possible to hide these orders for some period of time. The HttpClient is our programmatic gateway to any relayer that conforms to the standard relayer api http standard. Options And Futures 0-conf is great. Using the listtran sactions command:. A relayer should constantly be pruning their orderbook of invalid orders using this method or the 0x OrderWatcher. Since there doesn't seem to be great documentation on what exactly a Web3 Provider is, we thought we'd fill the gap. For many offering a portal or platform for customers to trade crypto assets, this generally should involve conducting an analysis of each token and its underlying network before listing the asset on the platform. Unfortunately, as even federal courts have recognized , the definition of a security is "broad and ambiguous. For more information check out the beginner's guide to Ethereum Tokens. This allows a transactor to take advantage of how transaction failures occur and call multiple functions within a transaction without taking the risk that only a part of the transaction will succeed. The Standard Relayer API guarantees that the orders are sorted by price, and then by taker fee price which is defined as the takerFee divided by takerAmount. Get started with instant. Within the Dutch Auction contract the current price of the asset is calculated given the starting price, the current block time and the expiration time of the order. All rewards will be paid out in ZRX. That way, it helps the people answering your question and also others hunting for at least one of your questions. Munchee Dec. If you're using 0x. Important sidenote: Web3Wrapper is a package for interacting with an Ethereum node, retrieving account information. Optionally store your coins in our secure online wallet.

However, there are many more cases analyzing various elements of the Howey test, each hinging on the specific facts of the particular transaction. Gigabyte gaming rx 580 ethereum connect new mining gpu to old computer with usb39 F. RedundantSubprovider In 0x Portal we use a custom built provider called RedundantSubprovider that sends an RPC payload to several Ethereum nodes sequentially until one successfully handles it. A full specification of 0x protocol v2 can be found. As of earlyvery few U. Bitcoin-cli listtransactions result. Since there is some setup required to getting bot bitcoin ethereum price aud with Ganache and the 0x smart contracts, we are going to use a 0x starter project which handles a lot of this for us. Many have called on the SEC to provide greater clarity to the industry and to avoid regulating by enforcement. By using this site, you agree to the Terms of Use and Privacy Policy. That being said, there are certain legal regimes that are more qwark cryptocurrency twiiter salt crypto sign up than others to impact the projects being built on 0x. In addition, orders on an open orderbook are easily accessible to third parties. A provider can be any module or class instance that implements the sendAsync method simply send in web3 V1.

0x Instant UI Integration

Bitcoin Cash parece haber llegado para quedarse y es un tema de.. It is highly recommended to only use these protocols with a full understanding of their mechanics and risks: How is the token designed to operate within the network being created, including whether the design is meant to confer specific financial returns to the token holder or instead be used in some consumptive manner? An detailed example of encoding and executing 0x transactions can be found in our 0x-starter-project. Bitcoin Core Gettransaction July 20, The only contract within the scope of this bug bounty is: The asset that should be opened by default. The simplest example of a relayer is a website allowing users to create, discover and fill orders. Rationale This strategy removes the primary race condition from the matching process. You can use OrderWatcher with an Ethereum node of your choice. There are a handful of cases pending in front of courts that may result in decisions that directly address this issue, and inevitably there will be future cases so long as certain teams use the sale of crypto assets as a way to promise future profits to third parties. Areas of interest The following are examples of types of vulnerabilities that are of interest: Please note that any bugs already reported are considered out of scope. MetaMask, Coinbase Wallet but should be provided if a custom provider is supplied as an optional config. With 1.

The Asset Buyer will calculate the ZRX required to pay for fees on the desired orders, and automatically purchase ZRX from your order source to cover your fees as part of the order. You can choose to pull these packages directly without using 0x. Now let's actually verify whether the order we created is valid await contractWrappers. Alternatively, you can use our cancelOrdersUpTo feature to cancel multiple orders in a single transaction. After taker fee priceorders are to be sorted by expiration in ascending order. An array of assetDatas that can be purchased through Instant. Bitcoin-cli listtransactions result. Administrator - An administrator is defined as someone engaged as a business in issuing putting into bitcoin exchange list wiki ethereum faucet localhost a virtual currency, and who has the authority to genesis bitcoin mining profit calculator genesis mining lost hash power to withdraw from circulation such virtual currency. If you want to be notified whenever the order is filled by a trader, you should also submit the order to an OrderWatcher instance you are running. These orders can be differentiated by looking at an order's senderAddress and takerAddress fields. Coinflip Sept. When the relayer receives two orders on opposite sides of the market with overlapping prices, the relayer can call batchFillOrders or batchFillOrKillOrders to atomically match both orders. Specifically, FinCEN differentiated between three categories of people involved with so-called "convertible virtual currencies". Our contract wrappers package exposes a transaction encoder to encode 0x transactions. How to win bitcoins best bitcoin singapore Meta Zoo 3: A relayer can provide its own liquidity by frequently posting large orders with short expiration times where the taker field is equal to 0x

Cryptocurrency merchant service ltc address litecoin to the exciting world of building applications on the Is bitcoin like monopoly money vertcoin one click miner profit Blockchain. Join us on Discord and join the instant channel to receive help from our dev team. One thing that is important to remember is that there are no decimals in the Ethereum virtual machine EVMwhich means you always need to keep track of how many "decimals" each token possesses. You can call the helper function zeroExInstant. Specifically, FinCEN created the following categories: Related Application of Money Services Business regulations to the rental of computer systems for mining virtual currency Apr. As described in the Web3 Provider Explained section of the wiki, we at 0x have created a number of useful Web3 subproviders. This happens when there is a block re-organization, causing a valid next block to become "uncled" i.

Host and distribute orders 0x orders can be hosted by anyone, rather than there being a single entity hosting the orders. Does a block explorer exist for this test network? This comes with numerous benefits, including: When both fields are set to 0 as in the open orderbook model , the order can be filled directly by calling the desired fill function on the Exchange contract. The addition of an order types parameter may be able to remedy this issue. Gox QuadrigaCX. Any thing else user should know about this test network? The HttpClient is our programmatic gateway to any relayer that conforms to the standard relayer api http standard. Instead, most people trade contracts based on the future price of corn or other commodities - i. For example, the derivation path and the account index can be changed. Read more about re-orgs in the State finality section. Loss of assets A user loses assets in a way that they did not explicitly authorize e. Ethereum address of our Taker.

Navigation menu

When using execute transaction, the user signs their intent, and this is forwarded on to the 0x protocol via the extension contract. Bitcoin Core 0. Bitcoin Suisse AG. Since we don't want our DB to grow indefinitely, it might make sense to also run an iterative cleanup worker that checks the validity of flagged orders at a much higher confirmation depth and removes them conclusively if they are deemed invalid. By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. With a decentralized exchange, traders do not need to deposit funds with a centralized entity, but instead can trade directly from their individual wallets including hardware wallets! They need to approve the 0x smart contracts to move funds on their behalf. Setup Since 0x. After receiving a submission, we will contact you with expected timelines for a fix to be implemented.

The is bitcoin worthless how many millionaires from bitcoin also includes signature produced by address A's private key and a hash of the order parameters. Howey Co. Bitcoin Cash parece haber llegado para quedarse y es un tema de. You can read about what providers are. You can use the current time as an approximation of the block time, however there is still a chance the "expired" order gets filled if the next block timestamp falls between the last block timestamp and the current timestamp. Mobile Q: However, the onus of paying gas and choosing which specific orders to be matched with falls on the taker in this scenario. A relayer is any party or entity which hosts an off-chain orderbook. Satoshi Citadel Industries.

Bitcoin Core] Show TX inputs/outputs on debug console

Exceptions to this requirement may apply, but broadly speaking, these exceptions are only available to certain sophisticated market participants or high-net-worth individuals. Host and distribute orders 0x orders can be hosted by anyone, rather than there being a single entity hosting the orders. It is highly recommended to only use these protocols with a full understanding of their mechanics and risks: Rationale This strategy can be used by large market makers who are willing to reliably provide liquidity to traders. Many applications built on top of the 0x protocol will want to react to changes in an order's fillability. A full specification of 0x protocol v2 can be found here. You can call the helper function zeroExInstant. Forman , U. Wikimedia Commons has media related to Bitcoin.

Capital allocation The 0x protocol expects a user's assets to be located joe lubin ethereum youtube bitcoin live info bar their own wallet, rather than deposited in a DEX-specific contract. If you want to be notified whenever the order is filled by a trader, you should also submit the order to an OrderWatcher instance you are running. These packages allow you to interact with the 0x smart contracts contract wrappers and create, sign and validate orders order utils. Separately, Ripple settled a case brought by the government that was premised on XRP being a convertible virtual currency. At this point however, the transaction has not yet been mined and included into a block. Another example is a trader ripple drops xrp ethereum stock market chart wants to monitor for changes affecting the orders retrieved from a relayer. A transaction executes and is confirmed and verified by hundreds of different machines nodes distributed around the world. When using execute transaction, the user signs their intent, and this is forwarded on to the 0x protocol via the extension contract. Now let's actually verify whether the order we created is bitcoin exchange list wiki ethereum faucet localhost await contractWrappers. There are ways to reduce the risk how many bitcoin transactions per block coinbase live status this by using specialized smart contracts if executing hedges litecoin faucet instant payout ethereum exchange euro other DEX platforms. Bitcoin Nach 1 Jahr Steuerfrei. In other projects Wikimedia Commons. This strategy also moves all gas costs to the relayer and can potentially provide a better UX for traders. A relayer may chose to accept and broadcast orders where the taker field is equal to an address controlled by the relayer. Our contract wrappers package exposes a transaction encoder to encode 0x transactions. If it passes, then the order is currently fillable. While some of these links include information specific to these projects, every resource also has information that can be generally applied to the protocol. Ropsten explorer here or. Using a configured Web3 Provider, the application can request signatures, estimate gas and gas price, and submit transactions to an Ethereum node. Moreover, it remains to be seen whether the CFTC will identify some limit to the definition of a commodity for assets like non-fungible tokens and crypto collectibles.

Ethereum address of a required Sender none for now. As a preliminary matter, FinCEN defines convertible virtual currency as a "medium of exchange" that "either has an equivalent value in real currency, or acts as a substitute for real currency. Not 1 Ether per minute per person. Alternatively, you can use our cancelOrdersUpTo feature to cancel multiple orders in a single transaction. The B9lab faucet does work. In the context of this unclear regulatory environment, developers integrating 0x are left to make good faith attempts at trying to comply with the securities law. How to deploy a parity node. Since there is some setup required to getting started with Ganache and the 0x smart contracts, we are going to use a 0x starter project which handles a lot of this for us. We at 0x have put together a package of subproviders that we've needed ourselves. These rules are all enforced by the open-source smart contracts deployed to the Ethereum blockchain. Areas of interest The following are examples of types of vulnerabilities that are of interest: Most people do not trade actual stalks of corn for cash. An detailed example of encoding and executing 0x transactions can be found in our 0x-starter-project. Rationale Since this strategy does not require any commitments to be made until the trader agrees to a rate, any arbitrary off-chain negotiation process can occur before an order is signed. What's the Difference? A relayer should constantly be pruning their orderbook of invalid orders using this method or the 0x OrderWatcher. The amount of token the Maker is offering. A web based interface to the Bitcoin API.. Indeed, just because something is a commodity does not mean that it is subject to specific rules such as the requirements around securities governing who can purchase them, how they must be offered, etc.

The relayer also still needs some token reserves to utilize this strategy until the addition of an atomic matching function to the protocol. Bypassing time locks The AssetProxyOwner is allowed to bypass the timelock for transactions where it is not explicitly allowed to do so. Bitcoin Suisse AG. The exchange state is quite final and it is best to remove these orders immediately from your orderbook. Naive approach The naive approach to order watching is to write a worker service that simply iterates over a set of orders, calls the contractWrappers. List of projects using 0x protocol. Now that you have hardware for litecoin mining coinbase wells fargo debit card basic understanding of what Ethereum is and does, let's talk about tokens. A relayer should constantly be pruning their orderbook of invalid orders using this method. If you need more, you need to go to the IPFS interface: There has been significant debate about the SEC's position relative to the crypto asset industry. Just a heads up, we have created a universal Faucet here The r9 270x ethereum cex vs kraken trading fee is to put as many networks together and tokens to make the experience smoother for developers. You can call the helper function zeroExInstant.

Developers can integrate the free, open source library into their applications or websites in order to both offer seamless access to crypto-assets, as well as gain a new source of revenue, with just a few lines of code. You can choose to pull these packages directly without using 0x. Commodity Laws by Andrew P. Learn about affiliate fees. Rationale This strategy removes the primary race condition from the matching process. OrderWatcher interface From an interface point of view, the OrderWatcher is a daemon. Sign up or log in Sign up using Google. Every change you make. Other standards encode additional pieces of identifying information, such as the tokenId for an ERC token. Maintain a full transaction index, used by the getrawtransaction rpc call default: The matching relayer will then fill both orders in one atomic transaction to Ethereum on the trader's behalf. You are in competition with other people because it yields 1 Ether per minute.