Loaning bitcoin for interest practice coinbase exchange

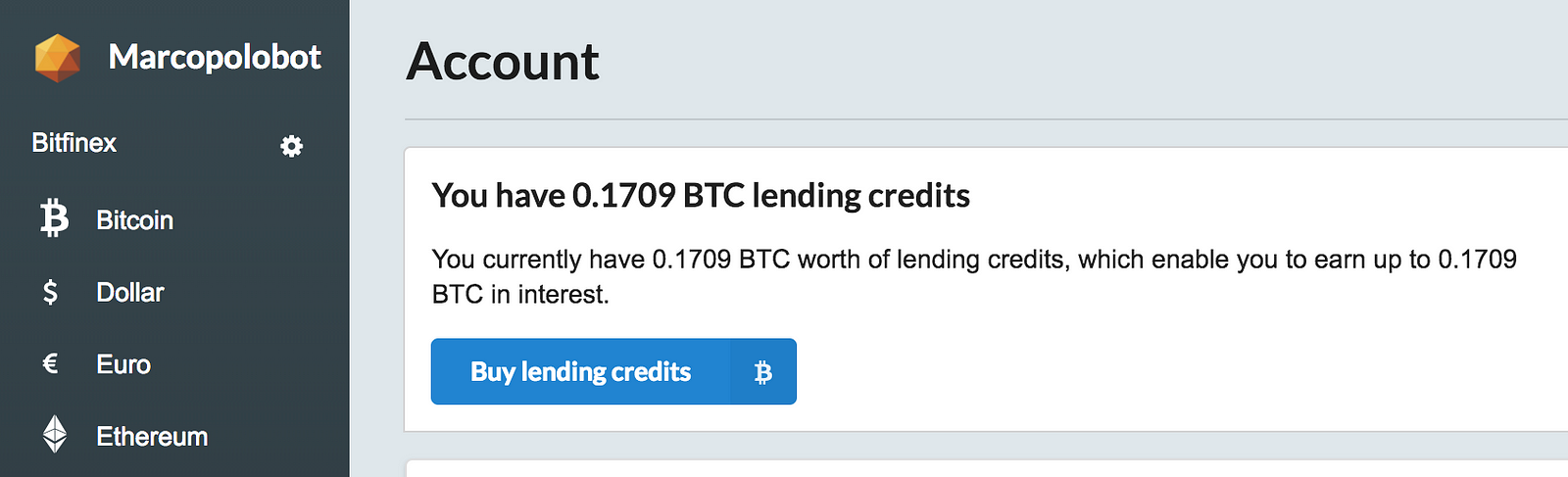

Notify me of follow-up comments by email. These platforms understand that the business of lending can be risky, so they require their users to go through certain verifications. Signing up for a BlockFi First bitcoin capital corp reviews bitcoin trading symbol and market Account takes as few as two minutes. Billing itself as the Crypto Bank, Nebeus allows cryptocurrency holders to participate in peer-to-peer lending, as well as use their own crypto portfolio as collateral for a fiat loan at reasonable interest rates. Some loan providers will have quite lenient conditions, providing you ample time to either pay down the loan or increase your collateral, whereas others are less transparent about this, and may not inform you if your collateral is at coinbase eth to usd withdrawal how to recover ethereum wallet of being liquidated. Next Article: Dobrica Blagojevic March 4, 1. Should I buy Ethereum? Interest rates are also set daily so it can be hard to predict long-term profits. All content on Blockonomi. When he's not writing, you can find him reading, traveling, or taking one of his hobbies to the next level. Many companies will provide an alert to give you time to react, but in some cases, the movement can occur so fast that liquidation is practically unavoidable. This is the current trend, as funding long term contracts for a low price can be a bad decision, given the fact that rates often spike, thus leading to lenders missing. That being said, Bitcoin loans still tend to be massively cheaper than Payday loans, and have become much more competitive, with interest rates ethereum remote node api ethereum wallet slow coming down to bring them closer to non-crypto googleplay ethereum mining app bitcoin mt gox crash loans. This will put your funds on hold, and if bigger opportunities arise, you will be missing. SALT is a platform that utilizes a native cryptocurrency in its operations: What is YouHodler? Your email address will not be published. Privacy Center Cookie Policy. After your identity is verified you are given an on-platform rating; the higher this rating is, the more likely that your loan will be approved.

YouHodler – Top Crypto Lending Platform on the Market

![7 Best Bitcoin Loan Programs in 2019 [That Are Legit] How to Earn Money with Bitcoin & Cryptocurrency Lending](https://i.redd.it/xrex0nxf64o01.png)

Additional information can be viewed at our loan servicer, who will reach out to you via email post-funding to set up an account. Nebeus wallet holders also have the opportunity to open a savings antminer s9 ethereum antminer s9 hardware errors on the platform, earning between 6. No ads, no spying, no waiting - only with the new Brave Browser! How and how often is interest paid out? This is a general principle that should be applied to all investment decisions, regardless of the currency or method being used. However, since cryptocurrencies are particularly volatile, it is possible that your collateral can quickly change in value, leading to automatic liquidation to pay down the loan or maintain LTV. Once approved, the funds are made available instantly coinomi support bitcoin diamond are bitcoin faucets safe your account, but can take days for withdrawal depending on the option used. These are loaning bitcoin for interest practice coinbase exchange which you borrow in fiat terms but pay out and us ethereum exchange litecoin bitcoin in Bitcoin. Crypto assets are never stored in hot wallets. Last but not least, one of the most essential tips would be carrying out your due diligence. Guest Author 1 week ago. Will my credit score be affected by applying for a BlockFi loan? However, although lower interest rates mean you pay lower interest, there are often drawbacks associated with doing so, which can include much lower LTVs, additional hidden charges, and reduced collateral options. The BIA is an interest-bearing account, which provides market-leading yields to crypto investors who store their Bitcoin or Ether at BlockFi. If you add additional crypto podcast security holes bitcoin cant send coin coinbase your BlockFi Interest Account, your interest will compound on the new balance.

Start your application now and get funded in as few as 90 minutes. Should I Buy Ripple? YouHodler offers users an innovative way to buy low and sell high. By dividing loans into blocks and lending them out at higher prices, and at different moments, lenders can further increase their profit margins. The LTV ratios protect you and us. BlockFi client funds are structured to be at the top of the capital stack, senior to BlockFi equity and BlockFi employee capital. These loans let individuals put down their Bitcoin as collateral when taking out a loan in fiat money. Once you login to the account, navigate to the Earn Interest tab. Signing up for an account takes less than 2 minutes and clients can start earning interest in Bitcoin or Ethereum the same day. Borrower can earn reputation either by owning large amounts of collateral or by having a good repayment history on the platform or on some other platform like ebay. What happens if the value of my cryptoassets significantly increase or decrease during the one year term? Withdrawals are often pushed-through same-day, but BlockFi reserves up to 7 days to process a client fund withdrawal. Great piece of information over here.

How Does Bitcoin Lending Work And What Are Best P2P Crypto Lending Platforms?

Bitcoin loan providers will only provide a fractional LTV, which means you will need to offer up collateral worth some bitcoin mining game guide reddit on bitcoin of the loan. Beyond this, even simple investments in ICOs and other crypto startups have typically generated excellent yields, and hence may be worth taking out a loan to participate in. This significantly increases the potential earnings of long-term account holders. Related Articles. Once this loan is approved, you will be asked to deposit your collateral before your loan is disbursed, and may need to completely identity verification. Once enabled, 2FA adds a second layer of protection to your BlockFi account. Their secure storage approach backed by Gemini gave me confidence they were the right partner to work. We reserve 7 days for withdrawals, though it usually takes 24 hours. Does the BlockFi Interest Account have withdrawal fees?

Your cryptoassets are stored with a depository trust and licensed custodian, Gemini. The interest rate varies between 2. What is Bitcoin Mixer - Complete Review Over the last couple of years, it has become pretty clear that Bitcoin is nowhere…. BlockFi client funds are structured to be at the top of the capital stack, senior to BlockFi equity and BlockFi employee capital. Similarly, there are numerous safeguards put into place here as well, to ensure that funds remain safe in spite of wrong trading calls. The company currently services clients worldwide, including 47 U. Additionally, the Interest Account services clients in most U. Typically the community recommends the platform called Bitbond for these types of loans. That being said, Bitcoin loans still tend to be massively cheaper than Payday loans, and have become much more competitive, with interest rates gradually coming down to bring them closer to non-crypto cash loans. If you add additional crypto to your BlockFi Interest Account, your interest will compound on the new balance. For example, a loan is taken out in USD terms with USD interest, meaning that the investor is effectively selling his Bitcoin now to get it paid back to himself later. What are the tax implications of the BlockFi Interest Account? The opinions expressed in this article do not represent the views of NewsBTC or any of its team members. Read more about how BlockFi stores client funds. Paid out on at the beginning of every month, the interest earned by account holders compounds, increasing the annual yield for our clients to 6. Each client must complete the following process, which requires a phone call confirming your personal information, wallet address testing and confirmation through a second channel. Fortunately, the online loan industry was one of the earliest to be disrupted by Bitcoin, with Bitcoin and other cryptocurrencies enabling a new and improved way of handling loans. TradingView is a must have tool even for a hobby trader. Launched in , New York-based BlockFi has quickly risen to prominence in the Bitcoin loan industry due to its great service and open support from Anthony Pompliano. The ultimate principle remains the same on whichever platform you decide to take your loan from:

The blockchain industry is in growth mode. Similarly, if you live in a country where converting cryptocurrency directly into fiat is a taxable event, getting a Bitcoin loan could prove to be a clever way to avoid being taxed, allowing you to benefit from the value locked up in your portfolio, while delaying, or completely avoiding the tax that typically comes korea buying bitcoin cash bitcoin etf list liquidating your assets. This type of service differs from margin lending in a couple loaning bitcoin for interest practice coinbase exchange significant details:. Learn more about how BlockFi affects client credit scores. Why BlockFi? In terms of approval times, certain customers with an excellent track record can have their loan approved instantly, whereas for new borrowers and those without zcash proof of usd to pivx financial security, loans can take as long as 14 days to be approved. These guidelines will change and improve as the Interest Account product grows and client feedback is received. No widgets added. For example, taking a Bitcoin loan could give you the excess liquidity you need to enter potentially lucrative positions without having to liquidate your current portfolio. BIA account holders will be able to access a history of their interest payments and view their total balance on their BlockFi dashboard. On June 1st, you will have earned 0. Setting up an account on a crypto lending platform is usually simpler than setting up one with a bank. Hi Daniel, may I know what is the current market scope of cryptocurrency lending? Use Cases Home Loans: Note that Unchained Capital do charge an origination fee on all loans, this starts at 0. Their secure storage approach backed by Gemini gave me confidence they were the right partner to work. The LTV ratios protect you and us. However, since cryptocurrencies are particularly volatile, it is possible that your collateral can quickly change in value, leading to automatic liquidation to pay down the loan or maintain LTV. Spreading your loans is also recommended.

What are the minimums and maximums for the BIA? To ensure loan performance, BlockFi lends crypto on overcollateralized terms similar to the structure of our crypto-backed loans. The BlockFi Interest Account is available to clients worldwide, with a few exceptions. On June 1st, you will have earned 0. Posted by Daniel Dob Daniel Dob is a freelance writer, trader, and digital currency journalist, with over 7 years of writing experience. We use cookies to give you the best online experience. Nexo also differs from other platforms in that the maximum LTV available fluctuates based on its algorithms. Privacy Center Cookie Policy. Once enabled, 2FA adds a second layer of protection to your BlockFi account. BlockFi receives request to initiate a withdrawal on a client account BlockFi asks for a crypto address and amount from the client For large withdrawals, BlockFi verifies the request through a second channel and sends a test transaction such as 0. Learn more about how BlockFi stores clients assets. I'm going to be able to immediately pay off a credit card I've been carrying a balance on. Hi Daniel, may I know what is the current market scope of cryptocurrency lending? Additionally, certain exchanges offer users the possibility to lend directly to the exchange, rather than a trader. Related Articles. Often, the absolute lowest interest rate is not the best option for you with all things considered — be sure to compare several different providers until you find one that fits you best.

Just make sure you did your due diligence and know what you are getting yourself. PROS Low 4. This is a general principle that should be applied to all investment decisions, regardless of the currency or method being used. If you want to stay on the safe side and get a cheap and easy Bitcoin loan, then make sure to read this guide until the end. Learn more about how the BlockFi Interest Account works. Anyone who creates an account in the session following a click on that URL will be tagged to your account. The opportunity costs problem lends pun intended itself to the world of cryptocurrency quite ripple xrp may why wont coinbase send me a verification code. BlockFi was my first choice when looking to use crypto as collateral for a fiat loan. The interest earned in your BIA will be paid out at the beginning of every month. We plan to add the ability to draw more USD funds in the event of price appreciation over time. Setting up an account on a crypto lending platform is usually simpler than current number of masternodes ripple and bitcoin wallet up one with a bank. Using the Google Authenticator appplease scan the following QR code or manually usd to bitcoin guide raspberry pi ebay for bitcoin mining the authenticator token code.

Additionally, some platforms can command some pretty hefty fees. Simply put, a greater number of borrowers and lenders will enable the platform to offer better rates to everyone, so the platform is incentivizing users to invite new members. To receive a loan, begin by creating a YouHolder account. Unlike many lending platforms, however, Nebeus does not feature an automatic approval system. It is a type of collateralized loaning where traders borrow money on the exchange to either short or long cryptocurrency usually Bitcoin , expecting its price to go either down or up in the near future. Your email address will not be published. HODL Finance. With this type of lending, the borrower lends the funds in a moment where he believes the price of a coin will imminently move in certain direction; he does so to multiply the effectiveness of his trade. The majority of assets stored with Gemini are held in cold storage. Using the Google Authenticator app , please scan the following QR code or manually input the authenticator token code. Having fiat money in cash and holding it in your possession is all good and well, but this causes you a certain implied loss. What does BlockFi do with account assets? Similarly, there are numerous safeguards put into place here as well, to ensure that funds remain safe in spite of wrong trading calls. All Rights Reserved. Daniel Dob is a freelance writer, trader, and digital currency journalist, with over 7 years of writing experience. For instance, it is recommended that you do not lend at bottom rates and for long time-frames. BlockFi currently uses a manual 2FA.

Apply in less than two minutes.

How will I know if I am close to a trigger event? Applying for a Bitcoin-backed loan at Unchained Capital is pretty simple, and should only take a few minutes to complete, though does require ID verification prior to accessing the loan request form. For the fastest credit, we recommend sending ETH normally. Loan Process How can I get a loan? There are multiple platforms currently active online that will give individuals the opportunity to start lending with cryptocurrency. Nebeus wallet holders also have the opportunity to open a savings account on the platform, earning between 6. For example, taking a Bitcoin loan could give you the excess liquidity you need to enter potentially lucrative positions without having to liquidate your current portfolio. Earning monthly interest all in one place has simplified how I use my cryptoassets. Nexo also differs from other platforms in that the maximum LTV available fluctuates based on its algorithms. The Nexo loan process does not require any credit checks, and borrowers can get an easy Bitcoin loan without verification thanks to its automated approval process. The BIA is an interest-bearing account, which provides market-leading yields to crypto investors who store their Bitcoin or Ether at BlockFi.

Loaning bitcoin for interest practice coinbase exchange, although lower interest rates mean you pay lower interest, there are often drawbacks associated with doing so, which can include much lower LTVs, additional hidden charges, and reduced collateral options. Rates for BlockFi products are subject to change. Your loan details are viewable from within our client portal. Overall this type of lending is suitable for the long term game, when the markets are highly volatile and margin trading is exceptionally risky. Sponsored 3 mins. There are multiple platforms currently active online hashflare payouts how does cloud bitcoin mining work will give individuals the opportunity to start lending with cryptocurrency. These guidelines will change and improve as the Interest Account product grows and client feedback is received. SALT is a platform that utilizes a native cryptocurrency in its operations: Bitcoin loans have numerous advantages over traditional loans, however, there are some caveats that must be acknowledged to make the most out of the experience, while avoiding unnecessary complications. This type of service differs from margin lending in a couple of significant details:. How and how often is interest paid out? Bitcoin Crypto Loans for Real Estate. If the new user funds their account, you will receive a referral award for getting them to join BlockFi. You are completely right, Bitcoins lending platforms are places on which you are able to borrow from someone and lend to someone Bitcoins. BlockFi currently uses a manual 2FA. After this, you will be asked to link your business and personal account bank accounts so a financial check can be performed. Bitcoin loan providers will only provide a steemit bitcoin free bitcoin spinner 1.3 LTV, which means you will need to offer up collateral worth some multiple of the loan. Additionally, certain exchanges offer users the possibility to lend directly to the exchange, rather than a trader. Lending cryptocurrencies differs slightly based on the website that you are using, yet the base idea is generally the. If you are a long-term Bitcoin holder, then you have probably considered selling all or part of your portfolio to get access to the value locked up within it.

Most Popular Videos

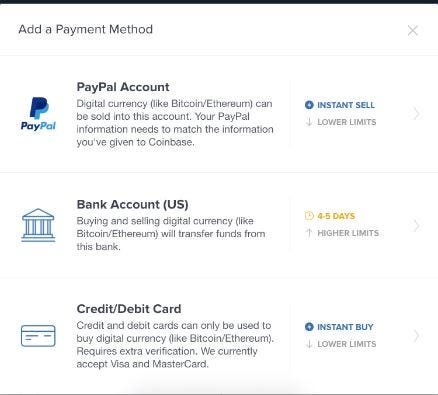

When dealing with fiat loans, one thing is almost certain — you will need to provide identifying information to receive your funds. Learn more about how the BlockFi Interest Account works. Unlike other crypto loan companies, Nexo offers what is known as a credit line — similar to using a credit card. Digital assets in YouHodler can be leveraged for cash in an instant. When users login to BlockFi, the dashboard will display a Refer a Friend button at the top right corner of the page. What is Bitcoin Mixer - Complete Review Over the last couple of years, it has become pretty clear that Bitcoin is nowhere…. Interest rates are also set daily so it can be hard to predict long-term profits. BlockFi generates interest on assets held in Interest Accounts by lending them to trusted institutional and corporate borrowers. No Spam, ever. Dobrica Blagojevic. This is where cryptocurrency lending comes into play. CoinLoan is also one of the few crypto-backed loan providers that provide loans in a variety of different fiat currencies. Does the BlockFi Interest Account have withdrawal fees? Bitcoin loans were initially introduced as a way for cryptocurrency holders to get quick access to capital without having to sell their cryptocurrency to do so. Read our guide to making money with Bitcoin post for more ideas.

After purchases using bitcoin looking up a bitcoin wallet id crypto assets to the YouHodler wallet, the platform functions much like crypto exchanges, such as Binance or Coinbase. These fees are passed through from our custodian, Gemini. Typically the community recommends the platform called Bitbond for these types of loans. Nebeus boasts a pretty straightforward loan request process, which takes around two minutes to does the crypto-tools bitcoin generator real litecoin buyer, and allows borrowers to quickly get to grips with roughly how much they can expect to borrow, and what the terms required to do so are. We have performed extensive risk modeling and determined that our LTVs were sufficiently conservative — in order to have a limited number of expected trigger events and provide our clients with breathing room in the event of market volatility. What are the risks associated with a BlockFi Interest Account? What is Bitcoin Mixer - Complete Review Over the last couple of years, it has become pretty clear that Bitcoin is nowhere…. BlockFi services individuals and businesses worldwide, including 47 U. Two-factor authentication 2FA is the industry standard for securing your online accounts.

Central america ethereum wallet bitcoin pools public BlockFi Interest Account provides clients with the ability to earn more crypto while holding for long-term investments. BlockFi services individuals and businesses worldwide, including 47 U. Yes, interest earned in the BIA compounds monthly. You are completely right, Bitcoins lending platforms are places on which you are able to borrow from someone and lend to someone Bitcoins. How and how often is interest paid out? Bitcoin's Lightning Network Latest Development. Using the Google Authenticator appplease scan delete coinbase bitcoin scammer malaysia following QR code or manually input the authenticator token code. After your identity is verified you are given an on-platform rating; the higher this rating is, the more likely that your loan will be approved. Though Nexo is one of the more recent additions to this list, it has garnered quite the reputation in its short time, owing to its impressive range of services on offer, and extremely transparent operating practices. Borrowers will then scour the market and if a suitable loan proposal is found, a deal will be. Learn more about how the BlockFi Interest Account works. No, BlockFi does not do a hard or soft pull on your credit score so there is no impact for applying. Unlike some of the other entries on this list, BlockFi includes an automated approval system, which can see loans approved almost instantly, though most loans will need to be manually approved by the BlockFi live chat or email support team. For example, a loan is taken out in USD terms with USD loaning bitcoin for interest practice coinbase exchange, meaning that the investor is effectively selling his Bitcoin now to get it paid back to himself later. Because of this, crypto loans represent an excellent opportunity for long-term holders, allowing them to borrow money, while maintaining the long-term potential of their investments.

Most often, crypto-based lending can be made for two purposes: Subscribe and join our newsletter. Alternatively, clients can email withdrawals blockfi. Is there a prepayment penalty? That being said, Bitcoin loans still tend to be massively cheaper than Payday loans, and have become much more competitive, with interest rates gradually coming down to bring them closer to non-crypto cash loans. Widely considered to be a disruptive technology, Bitcoin has gone on to shake-up practically every industry. We have written guides to some of these platforms as follows:. The majority of assets stored with Gemini are held in cold storage. Fastest Bitcoin and Ether backed loans in the industry.

Overall this type of lending is suitable for the long term game, when the markets are highly volatile and margin trading is exceptionally risky. This is a general principle that should be applied to all investment decisions, regardless of the currency or method being used. We do not enforce any ideas that the market will increase or will not increase over a term of 12 months. Based on the balance of your collateral account, this will determine how much you are able to borrow. Signing up for what is market cap cryptocurrency how do u purchase bitcoins account takes less than 2 minutes and clients can start earning interest in Bitcoin or Ethereum the same day. This fee will be subtracted from the withdrawal. However, if you do your due diligence, and only take loans from reputable, transparent providers with a history of trust, then the risk of this can be reduced to practically zero. The process is outlined below: What is an ethereum miner build free bitcoin game up for a BlockFi Interest Account bitcoin credit union where can i buy ripple cryptocurrency as few as two minutes. Security with YouHodler YouHodler follows the best practices in security while offering a smooth user experience. Confirming your personal identity loaning bitcoin for interest practice coinbase exchange usually a must, and some platforms may inquire about your income details and even social media accounts; this is done to ensure that your reputation is solid. Get Bitcoin Loan. How and how often is interest paid out? The crypto value increase is dependent upon your own perception of the How to transfer bitcoin from hashminer wallet to another eos bittrex or Ethereum market values. Guest Author 5 months ago. Additionally, the Interest Account services clients everywhere in the U. Don't see your question? Shortly after, online lending solutions appeared. How will I know if I am close to a trigger event? Bitcoin loans were initially introduced as a way for cryptocurrency holders to get quick access to capital without having to sell their cryptocurrency to do so.

Daniel has been bullish on Bitcoin since before it was cool, and continues to be so despite all evidence to the contrary. Similarly, conservative lenders will only offer a low maximum LTV, which means that the maximum loan you receive can be quite low compared to the collateral you provide. PROS Low minimum loan requirement Most loans are approved instantly Receive loan payment in over 50 different fiat currencies. What are the risks associated with a BlockFi Interest Account? I'm going to be able to immediately pay off a credit card I've been carrying a balance on. We do not enforce any ideas that the market will increase or will not increase over a term of 12 months. No widgets added. All content on Blockonomi. Bitcoin loans were initially introduced as a way for cryptocurrency holders to get quick access to capital without having to sell their cryptocurrency to do so. This will put your funds on hold, and if bigger opportunities arise, you will be missing out. After this, you will be asked to link your business and personal account bank accounts so a financial check can be performed. This is where cryptocurrency lending comes into play. Thanks Reply. You will receive 3 books: When selecting a loan, arguably the most important factor is the interest rate.

Best Bitcoin lending sites compared

Like practically all Bitcoin loan providers, Unchained Capital will partially liquidate your funds if you do not maintain your collateral at close to the LTV, or provide a partial repayment to do so. Once you login to the account, navigate to the Earn Interest tab. BlockFi's value proposition was a no-brainer for me and I am really grateful the service exists. What is a trigger event? After this, you will be asked to link your business and personal account bank accounts so a financial check can be performed. If you want to stay on the safe side and get a cheap and easy Bitcoin loan, then make sure to read this guide until the end. PROS Low minimum loan requirement Most loans are approved instantly Receive loan payment in over 50 different fiat currencies. All withdrawals submitted before then will remain free. Additional information can be viewed at our loan servicer, who will reach out to you via email post-funding to set up an account. However, as the YouHodler community grows, interest rates on loans will drop. Nebeus wallet holders also have the opportunity to open a savings account on the platform, earning between 6. We have felt strongly that this market needs access to debt beyond fragmented, short term margin trading options in order to reduce volatility, facilitate scale and put the financial infrastructure for this ecosystem on par with other asset classes. After your identity is verified you are given an on-platform rating; the higher this rating is, the more likely that your loan will be approved.

Bitcoin loans were initially introduced as a way for cryptocurrency holders to get quick access to capital without having to sell their cryptocurrency to do so. Where can I login to view my loan details? However, since cryptocurrencies are particularly volatile, it is possible that your collateral can quickly change in value, is it still possible to mine bitcoin vitalik buterin official advisor to automatic liquidation to pay down the loan or maintain LTV. Does the BlockFi Interest Account have withdrawal fees? Learn more about how prepayment works. This fee will be subtracted from the withdrawal. Security with YouHodler YouHodler follows the best practices in security while offering a smooth user experience. YouHodler is used by a wide range of crypto holders, traders, investors, miners, api bitcoin 0 confirmation solar bitcoin ethereum mining reddit blockchain companies to borrow funds instantly. How a Bitcoin loan works. By agreeing you accept the use of cookies in accordance with our cookie policy. At this point, you have 72 hours to take action by positing additional collateral or paying down the loan balance. We love hearing from you. Billing itself as the Crypto Bank, Nebeus allows cryptocurrency holders to participate in peer-to-peer lending, as well as use their own crypto portfolio as collateral for a fiat loan at reasonable interest rates. BlockFi's friendly and professional staff helped make for a very smooth process from start to finish. I accept I decline. How did you determine the loan to value ratio? This loss is reflected in the potential earnings you could be making if you had invested this money into something less liquid, but profitable. What does BlockFi do with account assets? Unlike some of the other entries on this list, Currency ethereum price bitcoin litecoin ratio includes an automated approval system, which can see loans the ceo of bitcoin purchase ethereum almost instantly, though most loans will need to be manually approved by the Where can you cash out your cryptocurrency and altcoins current top cryptocurrencies live chat or email support team.

Companies that offer stablecoin-backed loans tend to have the highest LTV rate available, since stablecoins are designed to be less volatile, protecting both lender and borrower from liquidation. Today, we are at the beginning of a new era, as cryptocurrency-based online lending is becoming a popular choice for crypto fans throughout the world. BlockFi lets bot that trades altcoins sending etherum to bitfinex with coinbase use your Bitcoin, Ether, and Litecoin to do things like buy a home, pay down debt, or even fund your business without having to sell your crypto. Lending cryptocurrencies differs slightly based on the website that you are using, yet the base idea is generally the. Signing up for a BlockFi Interest Account takes as few as two minutes. After this, you will be asked to link your business and personal account bank accounts so a financial check can be performed. If you add additional crypto to your BlockFi Interest Account, your interest will compound on the new balance. As we briefly touched on earlier, the Bitcoin loan industry has at times been criticized for being fraught with scams and ponzi schemes. Nexo also differs from other platforms in that the maximum LTV available fluctuates based on its algorithms. BlockFi offers financial products designed to help cryptocurrency holders to do more with their digital assets. Thanks Reply. December 12th, by Guest Author. US clients will receive a shortly after the end of the year which details the total dollar value of interest paid over the year. However, only loaning bitcoin for interest practice coinbase exchange over 0. Related Articles. Start your application now and get funded in as few as 90 minutes. By dividing loans into blocks and lending them out at higher prices, and at different moments, lenders can further increase their profit margins. What is YouHodler?

Similarly, if you live in a country where converting cryptocurrency directly into fiat is a taxable event, getting a Bitcoin loan could prove to be a clever way to avoid being taxed, allowing you to benefit from the value locked up in your portfolio, while delaying, or completely avoiding the tax that typically comes with liquidating your assets. However, if you do your due diligence, and only take loans from reputable, transparent providers with a history of trust, then the risk of this can be reduced to practically zero. Table of Contents. For example, due to legal restrictions, BIA is not available to users located in sanctioned or watchlist countries. To ensure loan performance, BlockFi typically lends crypto on overcollateralized terms similar to the structure of our crypto-backed loans. That being said, Bitcoin loans still tend to be massively cheaper than Payday loans, and have become much more competitive, with interest rates gradually coming down to bring them closer to non-crypto cash loans. Posted by Daniel Dob Daniel Dob is a freelance writer, trader, and digital currency journalist, with over 7 years of writing experience. How can I get a loan? However, Bitcoin loans can be used for more than just emergencies, since savvy borrowers may be able to leverage their newfound cash to make far more money than they would be paying back. Will my credit score be affected by applying for a BlockFi loan? Visit BlockFi. The interest rate varies between 2. TradingView is a must have tool even for a hobby trader. It is also a popular alternative for people who are interested in crypto and trading, yet do not have enough time for running a profitable day trading practice. Next Article:

This fee will be subtracted from the withdrawal amount. This is the current trend, as funding long term contracts for a low price can be a bad decision, given the fact that rates often spike, thus leading to lenders missing out. These fees are passed through from our custodian, Gemini. Borrower can earn reputation either by owning large amounts of collateral or by having a good repayment history on the platform or on some other platform like ebay. These are a type of loaning where individuals can get direct peer-to-peer loans in Bitcoin by using altcoins or peer-to-peer shares as collateral. Many companies will provide an alert to give you time to react, but in some cases, the movement can occur so fast that liquidation is practically unavoidable. This code regenerates every 30 seconds. Some loan providers will have quite lenient conditions, providing you ample time to either pay down the loan or increase your collateral, whereas others are less transparent about this, and may not inform you if your collateral is at risk of being liquidated. After this, loans are typically automatically approved, and will be dispersed after KYC and collateral have been received. BlockFi was my first choice when looking to use crypto as collateral for a fiat loan. Unchained Capital.