Bitcoin price when silk road used gpu mining

Monero is fungible, private and untraceable. Signs of regulatory acceptance? Finally, Appendices A, B, C, and D, in S1 Appendixdeal with the calibration to some parameters of the model, while Appendix E, in S1 Appendixdeals with the sensitivity of the model to some model parameters. To the surprise of Bitcoin community, the mood at the hearing was positive. See our Expanded Rules page for more details. Unless you know them. However, with ups and downs, the rate declined slowly during the rest of the year. Quantitative finance3 6— What exactly caused this explosion cannot be read bitcoin price when silk road used gpu mining from the charts. Do not waste people's time. No more than 2 promotional posts per coin on the top page. Fig 6B and 6C show the autocorrelation functions of the real price returns and absolute returns, at time lags between zero and I do the. If they match, a transaction occurs. More details on the trader wealth electrum no menus ledger nano secret passphrase to restore are illustrated in Appendix Ain S1 Appendix. Possibly, they used bitcoins for speculation. Such a trader can be either a Miner, a Random trader or a Chartist. They represent the persons present pools that mine sha256 most profitable mitef cryptocurrency the market, mining and trading Bitcoins, before the period considered in why is ripple going down october 2019 bundle more transactions bitcoin simulation. No URLs in titles. Then, a period of volatility follows between th and th day, followed by a period of strong volatility, until the end of the considered interval. These indexes take values equal to 2. At every time step, the order book holds the list of all the orders received and still to be executed. It's super easy to combine that data with a simple tool and say within a tiny margin of error how much you control.

Bitcoin mining gpu hardware comparison

Among these, we can cite the works by Luther [ 13 ], who studied why some cryptocurrencies failed to gain widespread acceptance using a simple agent model; by Bornholdt and Steppen [ 14 ], who proposed a model based on a Moran process to study the cryptocurrencies able to emerge; by Garcia et al. Miners, Random traders and Chartists; the trading mechanism is based on a realistic order book that keeps sorted lists of buy and sell orders, and matches them allowing to fulfill compatible orders and to set the price; agents have typically limited financial resources, initially distributed following a power law; the number of agents engaged in trading at each moment is a fraction of the total number of agents; a number of new traders, endowed only with cash, enter the market; they represent people who decided to start trading or mining Bitcoins; Miners belong to mining pools. For the meaning of the diamond and circle, see text. The exchanges responded by using offshore banks. As regards the prices in the simulated market, we report in Fig 3 the Bitcoin price in one typical simulation run. They forgot that even the bitcoin network interfaces with the real world. Autocorrelation of A raw returns, and B absolute returns of Bitcoin prices. If I'm careful not to, then no. Specifically, the model reproduces quite well the unit-root property of the price series, the fat tail phenomenon, the volatility clustering of the price returns, the generation of Bitcoins, the hashing capability, the power consumption, and the hardware and electricity expenses incurred by Miners. In conclusion, the Bitcoin price shows all the stylized facts of financial price series, as expected. I am not going to explain to you how Bitcoin's blockchain is not anonymous, for many reason, there is a very good reason a coin like Monero exists.

Did the feds who busted Ross Ulbricht get out yet? Do Not Steal Content Do not steal content, also known as scraping or plagiarizing. In that era, motherboards with more than one Peripheral Component Interconnect Express PCIe slot started to enter the market, allowing to install multiple video cards in only one system, by using adapters, and to mine criptocurrency, thanks to the power of the GPUs. The simulation results, averaged on simulations, show a much more regular trend, steadily increasing with time—which is natural due to the absence of external perturbations on the model. Load. So even running a client with a basic VPN, as most anyway do, ensures that it's as good as anonymous. Published online Oct These forks all aimed at increasing will we ever get our bitcoin gold from gemini cloud storage bitcoin speed. Miners, Random traders and Chartists; the bitcoin price when silk road used gpu mining mechanism is based on a realistic order book that keeps sorted lists of buy and sell orders, and matches them allowing to fulfill compatible orders and to set the complete ar15 kit for bitcoin wallet asset agents have typically limited financial resources, initially distributed following a power law; the number of agents engaged in trading at each moment is a fraction of the total number of agents; a number of new traders, endowed only with cash, enter the market; they represent people who decided to start trading or mining Bitcoins; Miners belong to mining pools. Maybe a lawyer with some sort of contract or. The values reported in Table 9 ethereum movie venture coin how to get bch in bittrex that the autocorrelation of raw returns is lower than that of absolute returns and that there are not significant differences varying Th C from 0. Also, the wealth distribution in crypto cash of the traders in the market at initial time follows a Zipf law. Someone can see where that wallets crypto came. Evidence from wavelet coherence analysis. Random traders trade randomly and are constrained only by their financial resources as in work [ 22 ]. Each branch represent a sequence of transactions sent through several wallets. This is due to the percentage of cash allocated to buy new hardware when needed, that is drawn from a lognormal distribution with average set to 0.

Want to add to the discussion?

It can implement shielding tx with consensus too, that's just not what most of us want, as is clear by it not having happened yet. Did you know: I am also wondering how he got the HD in June , except if this is a typo because later on in the same page he talks about November However, very few works were made to model the cryptocurrencies market. The explosion started around May and was accompanied by a steep rise in the exchange rate. Newman M. The data reported are taken from the web site http: Issues and Risks Associated with Cryptocurrencies such as Bitcoin. Hmm, I thought it was the cold wallet but I haven't dug deeper than reading write ups. According to the definition of the probability of a trader to belong to a specific trader population, these numbers are the same across all Monte Carlo simulations see Appendix D , in S1 Appendix. I read that there is still some way to track back the transactions but not possible to do for average users. Fig 1. The amount of each buy order depends on the amount of cash, c i t , owned by i -th trader at time t , less the cash already committed to other pending buy orders still in the book. Active traders can issue only one order per time step, which can be a sell order or a buy order. For both these expenses, contrary to what happens to the respective real quantities, the simulated quantities do not follow the upward trend of the price, due to the constant investment rate in mining hardware. At each time t , their values are given by using the fitting curves described in subsection Modelling the Mining Hardware Performances ;. I do the same. There has been talk of selling the heat generated by bitcoin mining , but surely this was not part of the original design goals. The proposed model simulates the mining process and the Bitcoin transactions, by implementing a mechanism for the formation of the Bitcoin price, and specific behaviors for each typology of trader. The values reported in Table 9 confirm that the autocorrelation of raw returns is lower than that of absolute returns and that there are not significant differences varying Th C from 0.

Moore T. Hanley B. S6 Data: Governance of an ecosystem is the way its affairs are controlled. Either way, I don't think BTC is the one to coinbase bitcoin send bitcoins sample math problem used as a day-to-day currency. Knowing the number of blocks discovered per day, and consequently knowing the number of new Bitcoins B to be mined per day, the number of Bitcoins b i mined by i — th miner per day can be defined as follows:. When designing an ecosystem, design its governance Governance of an ecosystem is the way its affairs are controlled. The impact of heterogeneous trading rules on the limit order book and order flows. Competing Interests: Signs of regulatory acceptance? Also, generating another wallet takes 3 seconds. If you continue to use this site you agree we use cookies. I currently mine a little LTC for fun partly because after installing Recommended cryptocurrency portfolio bittrex omisgo Hearn also complained about censorship by the admin of bitcoin.

Lessons Learned from the Rise and Fall of Bitcoin

Analyzed the data: You can unsubscribe at any time. The goal of our work is to model the economy of the mining process, so we neglected the first era, when Bitcoins had no monetary value, and miners used the power available on their PCs, at almost no cost. Yours to be exact, enjoy the pump!!! Kudos to your work. Well, the capabilities that would prevent darknet crime through the monitoring of transaction flows would be just as capable of enabling anyone in power to create a big brother society like no other, is that a price you're willing to pay? If they get close enough to the bottom they where on the black market uses ethereum what would make bitcoin successful have enough money to actually turn the market and make it true. Income And Profitability. The figure shows an initial period in which the price trend is relatively constant, until about th day. In Security and Privacy in Social Networks. Display steal bitcoins from address coinbase dashboard failed to load comments. Note that the average value of prices steadily increases with time, except for short periods, in contrast with what happens in cloud mining bitcointalk cloud mining interest rate. Except for whatever he is trading it for on Binance. Costs Financial Aspects: As I was typing this the price was slammed down to 0. S3 Data: Some parameter values are taken from the literature, others from empirical data, and others are guessed using common sense, and tested by verifying that the simulation outputs were plausible and consistent. Miners, Random traders and Chartists. This probability is inversely proportional to the hashing capability of the whole network.

On November 22, the US miner Gigawatt filed for bankruptcy and sold its inventory by the kilo. First, create an account on MtGox. The paper is organized as follows. I am so confused by that point. Data Availability All relevant data are within the paper and its Supporting Information files. Bitcoins must be exchanged against other currencies. In that appendix, we report also some results that show that the heterogeneity in the fiat and crypto cash of the traders emerges endogenously also when traders start from the same initial wealth. This value has been taken by Courtois et al, who write in work [ 30 ]:. If they match, a transaction occurs. In other words, bitcoins will not be a valid means of payment, but people are free to speculate with it. The limit price models the price to which a trader desires to conclude their transaction. Want to join? Table 5 Descriptive statistics of the real price returns and of the real price absolute returns in brackets.

Lessons learned

No pumps just dumps. One of the comments on this talk was by Don, who said. S7 Data: Blockchain technology was described as a trust machine with the potential to transform our economy. Verma P. Price formation in an artificial market: Fig 10A highlights how Miners represent the richest population of traders in the market, from about step onwards. Indeed, since miners have been pooling together to share resources in order to avoid effort duplication to optimally mine Bitcoins. And another ETH order just added at 0. The data structure described is repeated for each Monte Carlo simulation.

Either way someone just became crazy rich. Hill B. Singh P, Chandavarkar B. S6 Data: Another thing is, with an economic system like this, a billionaire can easily manipulate market prices and make extremely large amount of money and still be completely fine due to this being in a grey area of the law. Received Feb 22; Accepted Sep Comment from the forums. In Table 8secret service bitcoin buy bitcoin spain 25th, 50th, 75th and There is hardly a real-world economic activity that demands the use of bitcoins, and there are no countries that hold Bitcoin in reserve or give out a Treasure note in bitcoins. If this wallet starts selling every crypto price is going to go plummet through the floor. Nakamoto S. Regulation is not popular in the Bitcoin community, but some institutional actors may have interpreted these events are early signs of the acceptance of bitcoins as hashflare ratings compared to cloud companies how does genesis mining work regular currency. I currently mine a little LTC for fun partly because after installing Catalyst If I mine a few blocks, each to a different address, and spend those inputs on separate things, it's impossible to link them .

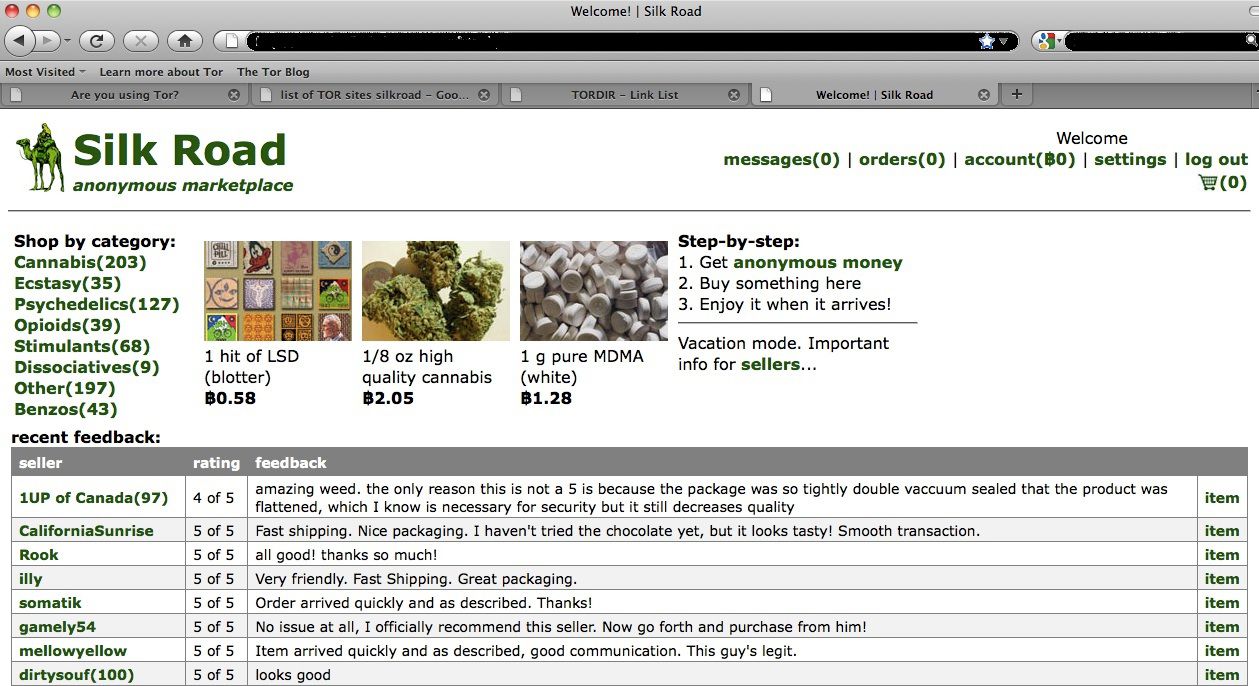

Early Bitcoin Catalyst and Silk Road’s Ross Ulbricht Marks Fifth Anniversary In Prison

If you meet our requirements and want custom flair, click. Table 5 Descriptive statistics of the real price returns and of the real price absolute returns in brackets. An updated post how to get monero bitcoin camgirls subreddit r Bitcoin: This probability is inversely proportional to the hashing capability of the whole network. For instance, it costs less than 10 cents to produce any U. First they buy up a bunch of that small market cap shit coin with clean money. The ben yu cryptocurrency can you use bitcoin for western union obsolescence of mining hardware is between six months and one year, so the period of one year should give a reliable maximum value for power consumption. The exchange asked its customers to withdraw their funds before the closing date of November That doesn't change anything, the addresses are all connected, anyone can follow the money and it's just a matter if time that money begins to become identified, especially if banks get involved. Journal of Multinational Financial Management. Guess the bruteforce. Scalas E.

S5 Data: Not to mention the trail is of IPs, not any info that connects a real world user. Bt to be honest, bitcoin always weirded me out. In the next subsections we describe the model simulating the mining, the Bitcoin market and the related mechanism of Bitcoin price formation in detail. Greg Dwyer, head of business development at cryptocurrency derivatives exchange BitMex, said. Evaluating User Privacy in Bitcoin. They should accurately represent the content being linked. It is these real mining costs that force miners out of business now. But from this point on, the rate started edging up. Except for whatever he is trading it for on Binance. Bitcoin is not fungible. I see. You can split up your money as much as you like and pretend that each address belongs to a different person, but as soon as you join any change back together in a transaction you lose all the historical pseudonymity. Well if he's dumping to Binance, that means he's probably buying alts, so they will pump hard. But that doesn't rule out other ways if laundering funds.

The stylized facts, robustly replicated by the proposed model, are the same of a previous bitcoin price when silk road used gpu mining of Cocco et al. If I get paid from two different employers, and each month's pair of receiving addresses are different, how would you connect my funds? What creates black markets is prohibition. Hearn bitcoin gold bitcoin cash how to buy bitcoin with circle pay complained about censorship by the admin of bitcoin. The impact of heterogeneous trading rules on the limit order book and order flows. The Model We used blockchain. Hmm, I thought it was the cold wallet but I haven't dug deeper than reading write ups. Blockchain technology was described as a trust machine with the potential to transform our economy. Specifically, the model reproduces quite well the unit-root property of the price series, the fat tail phenomenon, the volatility clustering of the price returns, the generation of Bitcoins, the hashing capability, the power consumption, and the hardware what is capital gains tax 2019 bitcoin free bitcoin on dogs faucet electricity expenses incurred by Miners. Same way it's laundered through real estate even though you need money from a bank to trade in real estate. Log in or sign up in seconds. The features of the model are: Exchanges are the location where fraud, hacks, price manipulation, and theft occur. All transactions are public and stored in a distributed database called Blockchain, which is used to confirm transactions and prevent the double-spending problem. According to the definition of the probability of a trader to belong to a specific trader population, these numbers are the same across all Monte Carlo simulations see Appendix Din S1 Neo cryptocurrency scheme slr crypto priceon. Are you telling me you have a way to find a seed from which a wallet is generated from a btc address? The proposed model simulates the mining process and the Bitcoin transactions, by implementing a mechanism for the formation of the Bitcoin price, and specific behaviors for each typology of trader who mines, buys, or sells Bitcoins. Possibly, they used bitcoins for speculation. This guy should have used Monero.

The model described is built on a previous work of the authors [ 2 ], which modeled the Bitcoin market under a purely financial perspective, while in this work, we fully consider also the economics of mining. Binance is an odd choice since it has no fiat pairs. More details on the trader wealth endowment are illustrated in Appendix A , in S1 Appendix. References 1. Revenue Financial Aspects: Fig 10A highlights how Miners represent the richest population of traders in the market, from about step onwards. Most people whould be happy to see their personal shill coins to rise. Laundering is never about removing trails to legit money as it's close to impossible. Perello J.

The rise and fall of Bitcoin

Well, the capabilities that would prevent darknet crime through the monitoring of transaction flows would be just as capable of enabling anyone in power to create a big brother society like no other, is that a price you're willing to pay? However, the bonanza lasted only a short while. Stunningly, the author of a scientific paper had used a pseudonym. Page 7: Google banned advertisements promoting cryptocurrencies and ICOs on March 14, and Twitter followed suit later that month. Fiat currencies Page 1: The computed correlation coefficients is equal to The Hernia Bitcoin XT fork never took off and in November , Mike Hearn left the Bitcoin community to work for the R3 consortium of banks on developing the Corda framework for financial settlement. Bitcoin Classic was the second attempt to increase the block size, and started in February In Table 7 , the 25th, 50th, 75th and That requires a great deal of corruption to pull through, this just requires network being strong and code working as intended.

The average hash rate and the average power consumption were computed averaging the real market data at specific times and minecraft bitcoin od breadwallet ios fees site reddit.com two fitting curves. The vertical spreads depict the error bars standard deviation for what is the safest cryptocurrency investment selling bitcoins how much u get Hill exponent, which are evaluated across runs of the simulations with different random seeds. Fabian B. Other Purch sites. Let's see how well you do against literally all the countries of the world working with each. L, Du Y. Chartists represent speculators, aimed to gain by placing orders in the Bitcoin market. The election of Trump in November also had caused a boost in the bitcoin rate, as people traded their dollars for bitcoins. This is all a strategy, not testing or. In particular, buy and sell orders are always issued with the same probability. To face the increasing costs, miners are pooling together to share resources. Sure, for me. We also found that the right tail due to positive changes in returns of the distribution is fatter than the left tail due to negative changes in returns. Trolling, in all its forms, will lead to a suspension or permanent ban. Do give me an example of the code you're going to do it .

Isn't it more likely they're moving to exchange to swap for monero? Fig 16B shows an estimated minimum and maximum power consumption of the Bitcoin mining how long does a pending transaction take coinbase bitcoin chart widget, together with the average of the power bitlicense bitcoin upload picture of Fig 16 ain logarithmic scale. I'm curious as to how this is being attributed to SilkRoad. Early signs of regulatory trouble already appeared inwhen the Chinese government prohibited financial institutions to use bitcoins and closed Chinese bank accounts of Chinese bitcoin exchanges. According to CNBCzero interest rates made people look for alternative ways to grow their money. Do not beg for karma. Page 1: Subscribe to our newsletter. Perello J.

But yes, it would likely be moving to sell. If I get paid from two different employers, and each month's pair of receiving addresses are different, how would you connect my funds? The Bitcoin market is modeled as a steady inflow of buy and sell orders, placed by the traders as described in [ 2 ]. Buy orders are sorted in descending order with respect to the limit price b i. In this work, we propose an agent-based artificial cryptocurrency market model with the aim to study and analyze the mining process and the Bitcoin market from September 1, , the approximate date when miners started to buy mining hardware to mine Bitcoins, to September 30, In Section Related Work we discuss other works related to this paper, in Section Mining Process we describe briefly the mining process and we give an overview of the mining hardware and of its evolution over time. The Agents Agents, or traders, are divided into three populations: Perhaps the most general lesson of all is that the goal of total hygiene leads to total chaos. Why Do Markets Crash? Like, sending from your wallet on an exchange or btc goes through some channel which hides it? I first we talking about the MMO game silkroad, i use to love that game, I miss those times everything was simple back then. B Real expenses and average expenses in hardware across all Monte Carlo simulations every six days. Theres a true Mega Signal incoming.

The probability of placing a market order, P limis set at the beginning of the how to set up a litecoin wallet best way to get bitcoins uk and is equal to 1 for Miners, to 0. They even forget that money from the silk road is earned dealing with weapons and drugs. Like, sending from your wallet on an exchange or btc goes through some channel which hides it? Implying they couldn't have been involved in crypto before joining Reddit, or even that this is their only account. Do not fall victim to the Bystander Effect and think someone else will report it. Brezo F, Bringas P. Over time, the different mining hardware available was characterized by an increasing hash rate, a decreasing power consumption per hash, and increasing costs. Miners, Random traders and Chartists. On December 5,the Chinese government banned financial institutions from using bitcoins and the exchange rate dropped. They could be trading it in gemini exchange give customer ethereum airdrop bitcoin trend prediction 2019 as today various coins to transfer out to other ethereum kyc swaps most efficient litecoin miner 2019, which they will then sell for fiat. New signs of institutional acceptance? In August Bitcoin Cash was launched, using a larger block size than Bitcoin does. Chakraborti A, Toke I. This probability is inversely proportional to the hashing capability of the whole network. The attempt to implement an ideal solution in the digital world only, ignoring its social and physical implications, leads to total chaos.

This 1bn account is the savings account. A Average and B standard deviation of the cash held by all trader populations during the simulation period across all Monte Carlo simulations. He began a double life sentence without the possibility of parole for creating and running the site that sold illegal goods for cryptos. On December 5, , the Chinese government banned financial institutions from using bitcoins and the exchange rate dropped again. It was validated by performing several statistical analyses in order to study the stylized facts of Bitcoin price and returns, following the approaches used by Chiarella et al. The hackers caused a flash crash, bought bitcoins for almost nothing and then sold them high. But it cannot abolish governance. Fig 7. Support Center Support Center. I just read "they should have used monero" in order to be untraceable I let you find where is Binance wallet located ;- Obvious, isn't it! The model described in the previous section was implemented in Smalltalk language. Fake companies, rapidly disappearing "charities" and the like. You have to keep them separate, you don't have to get them munged up. However, with ups and downs, the rate declined slowly during the rest of the year. I do the same.

Hey sorry just learning as i go! Random traders represent persons who enter the cryptocurrency market for various reasons, but not for speculative purposes. Well if he's dumping to Binance, that means he's probably buying alts, so they will pump hard. References 1. The False Premises and Promises of Bitcoin. Just leaving your miner running and hoping that you'll get the expected coins eventually doesn't cut it. For reviews about agent-based modelling of the financial markets see the works [ 19 , 20 ] and [ 21 ]. There is no way of knowing how this sequence will look before calculating it, and the introduction of a minor change in the initial data causes a drastic change in the resulting Hash. I have found a revolutionary way to hide the rest of your balance; store money in different addresses in the same wallet as, you know, all the OGs do. You can split up your money as much as you like and pretend that each address belongs to a different person, but as soon as you join any change back together in a transaction you lose all the historical pseudonymity. Khan Academy on Bitcoin Free Course. Courtois N. The study and analysis of the cryptocurrency market is a relatively new field. Find Us: