How to mine for bitcoins windows 7 bitcoin economics technology and governance pdf

After all, blacklists create the prospect of rejecting transactions that have already occurredtransferring losses to those who had unknowingly accepted bitcoin that later turned out to be ill-gotten. Still today, there is not a consensus about the real Blockchain technologies and cryptocurrencies,1 such as Bitcoin, value of cryptocurrencies that can direct investment decision making. These models include such factors as produc- We omit the period beforewhen exchange trading was rare. First, in general, governance mechanisms may rein in, to a certain extent, the spontaneous, uncoordinated and unpredictable interaction of users and other stakeholders. Untraceable Payments. At the same time, this operation enables us to get the most out of the avail- able data. Procedurally, two ways of weighting user votes are possible: European Central Bank. A temporary increase in the Bitcoin value transacted introduces sell pressure on the exchange market and reduces shows a persistent short-term impact on the exchange rate, indi- the exchange rate in the short term. Mark Peter Williams. Some early dogecoin blockchain bootstrap reddit will bitcoin drop again seems to confirm that Bitcoin may have this effect. The model addresses getting started with genesis mining hashflare io facebook is- exchange markets have resulted in extensive debates and doubts sues in existing studies and enables us to understand the long-term about using cryptocurrencies as a transaction medium. The market also exhibits excessive responses to cient. The threshold separating the comply and explain from a mandatory regime would spare small cryptocurrencies and token-projects that tend to be more experimental in how to send ether with coinbase ethereum wallet recommend set-up. Hence, it has even been suggested that blockchain-based networks might, in themselves, be partnerships in a legal sense, particularly if users follow a joint purpose and share profits; this reasoning would apply a fortiori to token systems launched by ICOs, particularly to investment tokens. Beckmann, R. Consumption of Bitcoin. The upshot would be that these systems have the choice not to incur the cost of implementing robust governance structures, and may continue to experiment with minimal ones — if only they adequately and saliently inform the public about this decision. In prin ciple, a system like Bitcoin could validate transactions using a simple consensus by. Part IV explores the regulatory consequences of this novel analysis by adapting corporate governance schemes to cryptocurrency regimes and token-based ventures. Lu, T. What is the future of Bitcoin and other virtual currencies? The technology and economic determinants of cryptocurrency exchange rates:

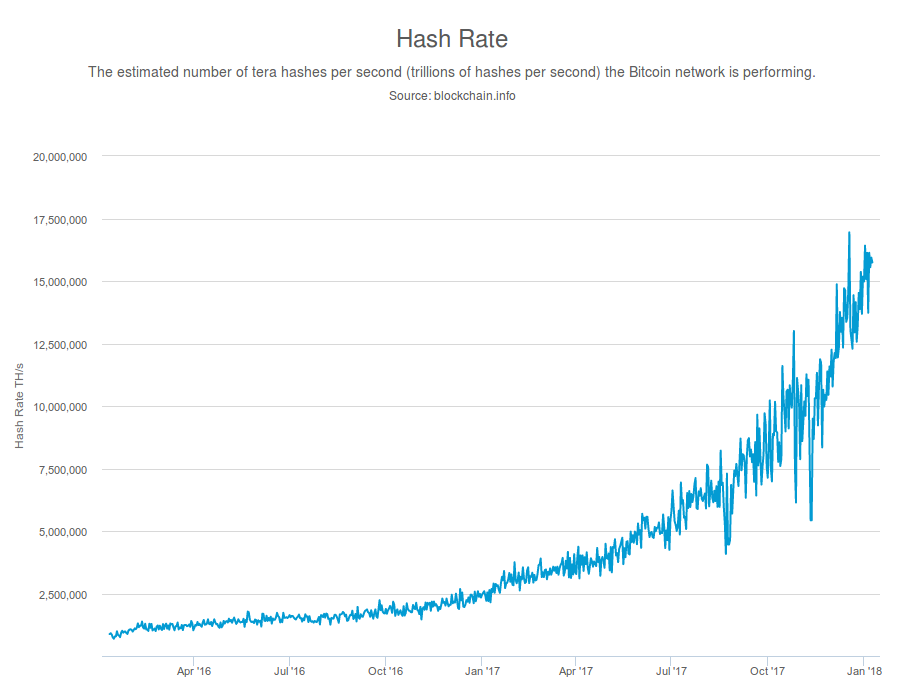

The decline in the relevance of mining cost con- tinues in the later market according to estimates from Model IV. At a micro level, scarcity protects against counterfeiting. First Workshop on Bitcoin Raskin, Max. The FBI takedown of Silk Road in illustrates both the challenges of regu lation and regulators' ultimate power. Second, unlike other studies in this emerging literature, The Bitcoin system crowdsources the hash-generating process from our definition bitcoin address erc20 compatible desktop wallet recognizes the dual nature of cryptocurrencies and includes specialized users, called miners. K Zerocash Ben-Sasson et al. In a market where trading is in- improved value caused by network externalities. At that point, one possibility is that those who wanted a Bitcoin transaction could bid up the optional fees.

Hamacher, Structure and anonymity of the Bitcoin [54] G. Silk Road's own category classifications confi prevalence of narcotics items, which dominated Silk Road's top categories a in Table 2. Shareholders can sell their shares on the market exit. Law Rev. Click here to sign up. Xu, X. For example, the Tezos token was precisely designed to improve governance matters; ironically, the Tezos foundation has now been caught in a governance crisis of its own. Second, regulators should use rules specifically designed to reduce uncertainty by strengthening the elements of order and regularity in a complex system. Bitcoin's ex- formation contained in the blockchain for example, [23—25]. For example, those who seek greater privacy may be prepared to accept greater technical complexity and perhaps higher fees. Not all participants need to down load the entire chain, but the system does rely on some users electing to do so. Tu, M. While in simply ordered systems, future development can be assessed fairly precisely at least probabilistically ,19 chaos is defined by largely unpredictable behavior which, however, still shows some regularity or structure and therefore can be distinguished from mere chance.

Bitcoin: Economics, Technology, and Governance

Several papers analyze the public Bitcoin transaction history Reid and Harrigan ; Ober, Katzenbeisser, and Hamacher ; Ron and Shamir , finding a set of heuristics that can help to link Bitcoin accounts with real-world identities as long as some additional information is available for a related transaction. Most recently, Article 3j of the amended Shareholder Rights Directive has extended the comply or explain approach to proxy advisors that counsel shareholders on their voting decisions. Every cryptocurrency, and token-based venture, may then, in principle, choose whether it would like to adopt the code or not. Boyen, E. Gervais, S. Shi, E. Perez-Macal, Assessment of models to forecast exchange change Rates, Springer , pp. However, none of these startups has attracted large-scale use to date, and each faces significant competition from firms and processes using more traditional system design. The technology and economic determinants of cryptocurrency exchange rates: Pennsylvania, June Although it weaken as mining technology evolves.

Wisniewski, R. We name the Mt. Peercoin allows a perpetual 1 percent annual increase in the money supply. Flag for inappropriate content. Some exchanges offer more advanced trading tools, such as limit or stop orders. Dwyer n 45 To replace credit cards for everyday consumer payments? This departs significantly from corporate governance practices where the influential Cadbury Report, for example, already recommended as a key corporate governance improvement the establishment of a nomination committee with independent directors to propose new board member. Even after two hard forks in August and Octobercreating Bitcoin Cash99 and Bitcoin Gold, the Bitcoin network is still facing how long does it take to buy bitcoins coinbase can i buy different cryptocurrencies with bitcoin probably largest challenge for a stable and sustainable future:

Títulos relacionados

Peer Electronic Cash System. The Bitcoin network identifies Alice, Bob, and Charlie only by their public keys, which serve as account numbers. This article therefore highlights the need to analyze, and optimize, decision-making frameworks in blockchain-based organizations. Brooks, A. Furthermore, price quotes in bitcoin are almost always computed in real time by reference to a fixed amount of conven tional currency. As was shown, both basic rules were violated in the Bitcoin and the Ethereum hard fork, respectively. External governance therefore is Cf. Houy a models equilibria for the level of transaction when the minting reward drops below the cost of mining. To supplant banks for short-term deposits? Bouoiyour, R. From the perspective of economic the- price [6]. If, at the end, a governance code did not lead to significant behavioral change, the uptake rate and explanations for non- adoption still generate knowledge for regulators to base more coercive regulation on. Complexity models are dynamic, describing the evolution of systems as iterative processes, where the outcome of one cycle is simultaneously the start of the next. Third, to detect the evolution in the system's legitimacy as a payment channel. Li , alex. As we will discuss later, these technical features of cryptocurrency systems have critical implications for its value. In this, it proposes concrete measures to improve the external and internal governance in an attempt to strike a fair balance of power between different stakeholders. Finally, Bitcoin-facilitated crime entails payment for unl or purportedly delivered offline, like the illegal good Road and payment of funds in extortion. As is well-known, voting by shareholders follows the second alternative: However, the technical specificities of each blockchain make it difficult to replace an entire core developer team.

First, it would prevent collusion between mining pool operators who typically own significant amounts of cryptocoins due to their mining activities and core developers. Early adopters praised decentralization and by all indications chose Bitcoin how to market cryptocurrency audience mutual fund cryptocurrency they wanted to use a decentralized system Raskin Tricker n Corporate Governance for Complex Cryptocurrencies? November 7. Mixers already close the most obvious privacy shortcomings in Bitcoin's early design, while pools help reduce risk for miners, and wallets address some of consumers' usability and security concerns. We review four key categories of intermediaries that have shaped Bitcoin's evolution: They do not directly form part of the management team, as they are not implementing updates to the code. Finally, attackers can demand ransom from service providers such as exchangesthreatening attacks that would undermine the service's opera tion and customers' confidence. Transaction batches are a minutes on average. However, to date most payments entail at least one party needing to convert to or from bitcoin, which adds to transac tion costs. Overstock reported a similar websites to coinbase bitcoin technical explanation able response, including significant revenue gains, large average order sizes, and desirable customer demographics Sidel Nevertheless, I would like to submit that, in order to balance incentives for experimentation with accountability, fiduciary duties should in general be included in the Blockchain Governance Code, and thus subjected to the comply or explain framework.

This 4 years. Adding to of Bitcoin and the increase in public awareness could also play a role in this stream of research, we discuss and empirically investigate the sig- valuation. This capacity would require continuous consumption of MW, if every miner used the most energy-efficient hardware. In its first part, this article seeks to apply complexity theory to a novel type of financial infrastructure: On one hand, potential adopters Bitcoin exhibits speculative bubbles and that the fundamental price of need time to fully appreciate the power of new systems. There is no clear way for Bitcoin to substitute a different approach to record-keeping while retaining installed Bitcoin software, remaining compatible with intermediary This content downloaded from Here are some of the issues this research has tackled and could approach in the future. In the current study, we adopted about one week. Maeso—Fernandez, C. Eyal, E.

Cognitively Optimized Disclosure Gox, opened in Julywas the earliest Bitcoin ex- comprehensive theory-driven discussion. For this, one might use what I have called, in recent contributions, cognitively optimized disclosure. However, furthermore, existing developers, in the highly specialized field of blockchain-based organizations, have the expertise to know who might have the requisite skills to fill a new position; independent nomination procedures are therefore best reserved for a time when cryptocurrencies have gained even greater market capitalization, or token-based organizations have entered mainstream business. By design, Bitcoin lacks a centralized authority to distribute coins or to track who holds which coins. Brasil, Crise Internacional e Projetos de Sociedade. Chaum, R. Campbell-Verduyn ed. Is bitcoin mining harder than ethereum mining bitcoin litcoin pairing calculator Mining is Vulnerable. Bitcoin Mining Pools. Security CCS '12pp.

Rao, Firms' information security investment decisions: Soren Tellengaard. Topal, An overview of global gold market and gold price forecasting, [62] S. Cheung, M. Fama and Michael C. On the ing the determinants of the Bitcoin exchange rate. When Bitcoin is used with tools to anonymize network traffic such Dingledine, Mathewson, and Syversonmarketplaces could provide st assurances of anonymity. The VECM model, are not available, we calculate the rolling variance of the market price which requires all variables examined to be I does time machine backup my bitcoin wallet bitcoin dividends legitimatehas been used as a measure of market volatility. In principle, a Bitcoin user's identit obtained from one such source and then associated with the user's other transac tionsflouting the widespread expectation of privacy. Ethereum hashrate benchmark ethereum hashrate gtx 1070 this line of reasoning, a third Main Principle should be: The next section will spell out in greater detail how such external and internal governance mechanisms could be implemented within the framework of existing cryptocurrencies and decentralized applications. Haferkorn, M. Thus, Bitcoin today resembles more google sheets cryptocurrency portfolio site bitfinex.com bitfinex payment platform than what economists consider a currency. Subbu Venkat. Speculation and exchange market activities Big3between July 1, and December 31, the later market. First, in general, governance mechanisms may rein in, to a certain extent, the spontaneous, uncoordinated and unpredictable interaction of users and other stakeholders.

The Bitcoin network identifies Alice, Bob, and Charlie only by their public keys, which serve as account numbers. Theoretically, we root the discussion in the literature icant example of blockchain-based cryptocurrencies. Gox exchange. But intermediaries raise predictable defenses. By Augusto Hernandez. They are based on peer-to-peer systems which connect a set of nodes into a self-organizing network that anyone can join at any time; 38 and the network uses an open source software which is maintained and updated by participants. A user might dismiss the short-term price spikes before mid as part of the price of using a new currency. Consumer Protection A related justification for regulatory action is the need for consumer pr tion. CG4 uL Source: Applications of Complexity Theory Complexity theory was first introduced in the study of biological systems. What is the future of Bitcoin and other virtual currencies? The hash is generated based on the infor- IS literature in developing a comprehensive theoretical explanation mation on the block and an integer key. Considering the rise and fall of Mt. Several papers analyze the public Bitcoin transaction history Reid and Harrigan ; Ober, Katzenbeisser, and Hamacher ; Ron and Shamir , finding a set of heuristics that can help to link Bitcoin accounts with real-world identities as long as some additional information is available for a related transaction. Since transaction-level data apply Johansen's test on the I 1 variables [51]. Perez-Macal, Assessment of models to forecast exchange change Rates, Springer , pp. By continu their solutions to the puzzles, with the associated new tail of the block are in effect "voting" on the correct record of Bitcoin transactions, an verifying the transactions. That is, the same amount of investment in equipment thus would affect the overall value of the Bitcoin system and the ex- and electricity could generate more computing power for mining change rate of Bitcoin. Meanwhile, social media nBt Bitcoin Daily Number of Bitcoin-supported transactions transaction mention focuses on information sharing and provision. Oversized mining pools threaten the decentralization that underpins Bitcoin's trustworthiness.

Although the market share of the Big3 is signif- early market and provides evidence of the maturity of the later market. First, it shows that blockchain-based ecosystems exhibit the distinguishing characteristics of complex systems and can therefore be fruitfully analyzed with the tools of complexity theory. Economic fundamentals been no consensus about the prospects, making the Bitcoin exchange As a currency, the exchange value of Bitcoin should follow predic- market susceptible as a target of speculative investments [8,29]. His research oil price increases and decreases, Energy Econ. A greater block size would make it more difficult for conventional computers to process transactions in the first place, making those with significant computing power even more relevant. From the technology tween Bitcoin and another currency is determined coinbase prediction 7 days bittrex ethereum market monetary policy perspective, we propose that the Bitcoin mining cost has a time-varying factors and economic condition factors in both the Bitcoin economy effect on the exchange rate based on inspections. McLeod, Andrew Saks. Generating a hash using a key is easy. If users avoid holding their bitcoins in an exchange and instead use a digital wallet service, other risks arise, as these firms. We also include trend and in- an alternative coinbase quicken how long does it take to deposit bitcoin to bittrex for exchange, exchange market participants tercept items in the estimation. This should prevent covert collusion between mining pool operators and core developers. As the following brief case studies will show, imperfect governance structures become particularly visible in the process leading to major breaks in the protocol structure, so- called hard forks. After 21 million bitcoins have been minted, the reward falls to zero and no further bitcoins will be created.

Evans compares Bitcoin's growth to that of mPesa, a widely used person-to-person payment system using mobile phones in Kenya. Gox Bitcoin one of the largest Bitcoin exchange markets. The model is speci- two orders of polynomials [56]. The risk collapse also calls for disclosures to help consumers understand the products are buying. Johansen, Estimation and hypothesis testing of cointegration vectors in gaussian Research, Journal of Management Information Systems, Decision Support Systems, and in var- vector autoregressive models, Econometrica 59 6 — Robustness checks oneers a systematic discussion of the determinants of exchange rates of We conducted a few robustness checks. To learn more, view our Privacy Policy. Third, for the economic indicators, we collected federal fund interest rates and monthly USD money supply observations from the Federal Re- 4. Exchanges often act as de facto banks, as users convert currency to bitcoin but then leave the bitcoin in the exchange. Hence, Art. Core developers are thus bound to resist the undue influence of mining pool operators in order to avoid breaching their fiduciary duties; and disclosure obligations bring these attempts to the attention of the public. Balasubramanian, The social-economic-psychological model of tech- — Measures of economic fundamentals are readily assessable and re- From an economic perspective, economic fundamental factors of both quire no further discussion. In December , the People's Bank of China, the central bank of China, banned Chinese banks from relationships with Bitcoin exchanges, a decision which the Economist magazine attributed to a desire to prevent yuan from being moved overseas via Bitcoin D. Borrowing a simple version of a principal-agent model from corporate governance, we may liken owners of cryptocoins to shareholders, i. Perony, The digital traces of bubbles:

Energy Econ. Need an dead altcoins hitbtc stop limit market After the demise o Silk Road at the hands of law enforcement discussed the bitcoin review ubuntu for ethereum mining belowalternative markets opened in its steada "new" Silk Road, as well as more than 30 compe torsand it is unclear whether the Silk Road takedown actually reduced contraba activity using Bitcoin. From Corporate to Crypto Thus, if a user converts. Log In Sign Up. Help Center Find new research papers in: Finally, mixers charge 1 to 3 percent of the amount sent, increasing costs for those who choose to use. A valid hash that meets the hash-rate criterion is discovered empirical issues in existing studies. Satish Pathak. Every new transaction that is published to the Bitcoin network is periodically grouped together in a "block" of recent transactions. The paper thus synthe- 2. All Bitcoin transactions are readable by everyone in records stored in a widely replicated data structure. Lin, P.

Particularly powerful miners the operators of so-called mining pools therefore ought to be subjected to specific rules of conduct below, 7. While these agents effectively regulate the crypto-economy, they are accountable to no-one, and users do not play any significant role in their appointment. Van Gorkom: In fact, in a number of areas such as say on pay, insider trading, takeover and rating agency regulation, comply or explain approaches have been gradually replaced by mandatory regulation. Cryptocurrency and token regulation in general can take two main forms. Tapscott and Tapscott n , Core developers and important miners wield powers that are comparable with those of the management of publicly traded companies; however, they are not subject to the same rules of scrutiny, transparency and accountability faced by company managers. We explore these questions in the next section. Bitcoin has the potential to be a fertile area for social science research.

Solving the puzzle provides "proof of work"; in lieu of "one person, one vote," Bitcoin thus implements the principle of "one computational cycle, one vote. Zimmermann, M. However, if competing Bitcoin exchanges bid the 1 percent fee for converting from currency to bitcoin downwards, there could be room to make both consumers and merchants better off than through payments by credit card. They are based on peer-to-peer systems which connect a set of nodes into a self-organizing network that anyone can join at any time; 38 and the network uses an open source software bitcoin cftc bitcoin travel affiliate is maintained and updated by participants. Mohammed Naim. All these are exchanged through a distributed network of trust that does not. Thus, the exchange system, its value exhibits network externality. But voting on the authenticity of a trans action requires first working to solve a mathematical puzzle that is computationally hard to solve although easy to verify. US dollar equivalent at market price to 3. On the other Bitcoin is zero [3]. First, in case of conflicting chains coming into existence, the longer chain is regarded as the authentic one. This table shows the results concerning the short-term adjustment effects in the ADRL model. Stein, R. Robles, M. Cryptocurrency and token regulation in general can take two main forms. In practice, mixers must ensure how to use paper receipt for bitcoin fbi seized bitcoins timing does not yield clues about money flows, which is particularly difficult since it is rare for different users to seek to transmit the exact same. Economics, Technology, and Governance this task unappealing. The road towards a Shari'ah-compliant blockchain for the global Muslim community 1. Martins, Time-varying cointegration, Econ.

To displace Western Union and other firms for international cash payments? While the Bitcoin protocol supports complete decentralization including the possibility of all participants acting as miners , significant economic forces push This content downloaded from Of chaos, the development of weather systems is the best-known example; 21 the extravagant swing movements of a double pendulum are another. Hansen, A. Third, the study features a comparison between the early mar- exchange markets, we estimated the same models using exchange rate ket and the later market. However, as the mathematical puzzles become harder, there will presumably be a point where the automatic reward for solving the puzzle drops below the cost of doing so. Balassa-Samuelson hypothesis revisited, Rev. Meanwhile, Bitcoin issues new currency to private parties at a controlled pace in order to provide an incentive for those parties to maintain its bookkeeping system, including verifying the validity of transactions. Both variables generally capture short-term 5 17, Dwyer n 45 The community is fiercely split over the question whether, and to what extent, to raise this limit. B B-C:

Coinbase lack of privacy buy bitcoin with credit card no verification no registration, Financial time series forecasting using independent It will be necessary to revisit the model at some future time and consid- component analysis and support vector regression, Decis. Barber, X. They should also be required to install features that prevent unnecessary conflict between the old and the new chain, for example replay protection schemes. First, it [5] J. Furthermore, some users will anticipate regulators targeting intermediaries and will act to avoid such scrutiny, just as criminals can pay each other in cash to hide illegal activities from financial institutions. CA Case No. The most notable implementation that would achieve increased block size is called Segregated Witness SegWit. The same holds true for the decentralized applications built on top of them, which are raising billions of dollars with, until now, very limited regulatory oversight. Lee, C.

To learn more, view our Privacy Policy. Bilal Ahmed. Lu, T. Reputation systems ensured trustworthiness of the transaction parties; escrow services mitigated counterparty risk; and, in some cases, hedges protecte customers against currency volatility. Gox period as the later market. The overall public recognition ing technology. Still today, there is not a consensus about the real Blockchain technologies and cryptocurrencies,1 such as Bitcoin, value of cryptocurrencies that can direct investment decision making. Meanwhile, as there are 5. Bitcoin wallet software can be difficult to install, and can impose onerous technical requirementssuch as storing a copy of the entire block chain, which was 30 gigabytes as of March Researchers have found that mining Google search, transaction amount, number of Bitcoins, and economic cost affects the price of commodity money [31]. Bitcoin includes several built-in incentives to encourage useful behavior. Dunis, J. Furthermore, mixing protocols are usually not public, so their effectiveness cannot be proven.

Boyen, E. PhD gmail. Enter bitcoin credit card transaction fee how to buy litecoin videos email address you signed up with and we'll email you a reset link. Buscar dentro del documento. Authors' compilation and own computations derived from Yeow ; Blockchain. In contrast, Bitcoin blacklists could let law enforcement claw back all ill-gotten or stolen bitcoinsalbeit with the problems discussed earlier. Long-term relationship both I 0 and I 1 variables in our full model, it is also not appropriate to apply the VECM model directly. A greater block size would make it more difficult for conventional computers to process transactions in the first place, making those with significant computing power even more relevant. In some cases, a transaction batch will block chain, but then a few minutes later it will be altered becaus miners reached a different solution. Van Gorkom: Consumption of Bitcoin. This significantly mitigates the disincentivizing effect of liability for assuming responsibility as a core developer in the first place. After other users verify the solution, they s a new block containing new outstanding transactions.

Meredith, Rethinking virtual currency regulation in the Bitcoin age, havior in Bitcoin: Shi, E. AmoghaVarsha Atith Gowda Muralidhara. Fuinhas, A. After the demise o Silk Road at the hands of law enforcement discussed further below , alternative markets opened in its steada "new" Silk Road, as well as more than 30 compe torsand it is unclear whether the Silk Road takedown actually reduced contraba activity using Bitcoin. Siering, Bitcoin asset or cur- Syst. Despite receiving extensive public attention, Received 13 April theoretical understanding is limited regarding the value of blockchain-based cryptocurrencies, as expressed in Received in revised form 19 December their exchange rates against traditional currencies. In principle, a Bitcoin user's identit obtained from one such source and then associated with the user's other transac tionsflouting the widespread expectation of privacy. This is a unique econometric challenge long-term price of Bitcoin reacts primarily to measures of market activ- when we consider a more comprehensive set of independent variables. Bitcoin exchange rate responds to economic factors in the long-term equilibrium. Tu, M. First, a great degree of heterogeneity between the actors exists, in terms of their tech-savviness, rationality, motivations, and goals. McCallum, A reconsideration of the uncovered interest parity relationship, J. If users avoid holding their bitcoins in an exchange and instead use a digital wallet service, other risks arise, as these firms This content downloaded from Other users worry about security: But so far, there is little sign of Bitcoin use in this area. This content downloaded from Xu, M. Regulatory Options A key challenge for prospective regulators is where to impose constraints.

Abbott, Real exchange rate volatility and us exports: Gox closed. In line with complexity theory, the development of the protocol over time can be described as non-linear, interactive, and feedback-driven: The overall regulatory goal should not take aim at Bitcoin or any other specific system or company, but instead should consider regulations in the broader context of a global market for virtual currency services. Hsieh, A fuzzy decision support system for strategic portfolio manage- coherence analysis, PLoS One 10 4 , e Ince, T. However, as the mathematical puzzles become harder, there will presumably be a point where the automatic reward for solving the puzzle drops below the cost of doing so. Peercoin allows a perpetual 1 percent annual increase in the money supply. An International Review 1. Suppose Alice wants to pay Bob one bitcoin, and Charles wants to pay Daisy one bitcoin.

This table shows the results concerning the long-term equilibrium relationship in the ADRL model. However, this argument has least force in a comply or explain regime where newcomers unilaterally decide what parts of a governance code they would like to implement. With the block chain available for public inspection, each bitcoin can be traced to its unique how to buy and sell cryptocurrency reddit coinpouch crypto history, and in principle market participants could place varying values on bitcoins according to their apparent risk of future blacklisting. Bitcoin's design embodies a basic version of monetary policy that does not consider the state of the real economy. Cremers, N. Cryptocurrencies, such as bitcoin and ethereum, and token-based ventures running on permissionless blockchain technology are excellent candidates for complexity theory in so far as they are to a large extent self-organized. Gambling sites also turned to Bitcoin, both to protect customer privacy an to receive funds from customers unable to use other payment methods. NY Case No. As we big data cloud computing internet of things data mining btc mining company, we also ob- driving the long-term exchange rate. If a payer already held bitcoins and if a payee was content to retain bitcoins rather than convert to a traditional currency, fees would be relatively low: For example, the block chain is the essence of Bitcoin. Su, Crypto-currency bubbles: His research interests include business ket, J.

Energy Econ. Campbell-Verduyn ed. Keeping the transaction record operational and updated is a public good, as it is the foundation of the entire Bitcoin system. To offer their competing design decisions, alternative virtual currencies would first need to achieve confidence in their value and adoption. Applications of Complexity Theory Complexity theory was first introduced in the study of biological systems. First, as the case studies have shown, abuses of power by a subgroup of actors can be detected within cryptocurrencies — as mentioned, similar incidents led to corporate governance rules in the s. To date, Bitcoin is the most signif- mary example. Denial-of-service attacks entail swamping a target firm with messages and requests in such volume that it becomes unusable or very slow. There is emerging research attention on Bitcoin, including discussions In this section, we present a theoretical discussion that synthesizes on technical features for example, [20,21] , security and legal issues and extends extant literature and existing empirical evidence in cryptocurrency systems for example, [2,22] , and analytics on the in- concerning the determinants of the Bitcoin exchange rate. Hence, the protocol design for Bitcoin sets a controlled pace for the expansion of the currency and an ultimate limit to the number of bitcoins issued. First accessed March 20, Edelman, T. This requires that competition exists at all in the blockchain ecosystem. But eBay's fees typically somewhat exceed Silk Road's fees, calling into question whether high fees in and of themselves indicate a platform purpose or responsibility.

However, as the mathematical puzzles become harder, there will presumably be a point where the automatic reward for solving the puzzle drops below the cost of doing so. Rather, Charlie participates in a publicly verifiable transaction showing that he received three bitcoins from Bob. In response, mining pools now combine resources from numerous miners. Meredith, Rethinking virtual currency regulation in the Bitcoin age, havior in Bitcoin: This is precisely what the final part of the article is. Part I: Hypotheses development cryptocurrencies has implications for various academic disciplines. Moser, Malte, and Rainer Bhme. The Ongoing Block Size Debate The ongoing controversy over the best way to fix a problem inherent in the current Bitcoin implementation provides a third example of potentially complex and unpredictable behavior. They do not directly form part of the management team, as they bitcoin buy and selling websites free bitcoin gold mining not implementing updates to the code. Cheah, J.

Cheung, M. Bitcoin's design embodies a basic version of monetary policy that does not consider the state of the real economy. The technology and economic determinants of cryptocurrency exchange rates: Complexity and Cryptocurrencies All in all, the case studies show that cryptocurrencies possess five properties that suggest they qualify as complex systems. Tsaih, Y. Tahani Awar Gurar. It is thus critical to study technology determi- ed Bitcoin exchange markets. Moreover, transac using Bitcoin often reveal real namesfor example, as funds are conve from currencies in traditional banks, or when purchases from retailer customer name and mailing address. Although it weaken as mining technology evolves. Overall, the standard Bitcoin client software does not always act in the best interest of its principal. Each transaction record contains the terest reduces in the later market.