Lower transaction costs bitcoin ethereum proof of stake fork

Currently, a tracking website ran by Peter Pratscher, the CEO of top ether mining pool Ethermine, best asic mining pool bitmain antminer d3 specs Constantinople adoption to be a mere The BIS report lower transaction costs bitcoin ethereum proof of stake fork ' Beyond the Doomsday Economics of proof-of-work in cryptocurrencies ' sets out what it describes as two fundamental limitations in the economics of payment finality in bitcoin and PoW. Favour consistency of nodes over availability To participate in voting becoming a validator you are required to stake ETH for which you'll be rewarded with additional ETH at some interest rate plus you'll receive a portion of the network transaction fees. Additionally, pooling in PoS is discouraged because it has a much higher trust requirement - a proof of stake pool can pretend to be hacked, destroy its participants' deposits and claim a reward for it. Subscribe to BNC's newsletters for insights and forecasts direct to your inbox. This has the unfortunate consequence that, in the case that there are multiple competing chains, it is in a validator's incentive to try to make blocks on top of every chain at once, just to be sure: David Hoffman, a blockchain researcher at Bunker Capital and host of the POV Crypto r7 370 hashrate ethereum splitter bitcoin, said that the new upgrade would significantly reduce the cost of staking. In a couple of years, Ethereum could be a very different protocol from what it has been until. Due to this upcoming reduction in miner payouts, miners such as Pratscher and Venturo are banking on a potential future upgrade, named ProgPoWthat promises to block specialized ASIC hardware from the network and ensure that GPU mining remains competitive. At present, each EIP will continue undergoing testing, implementation and peer-review in the weeks to come, though the process is by no means a linear progression. In BFT-style proof of stakevalidators are randomly assigned the right to propose blocks, but agreeing on which block is canonical is done through a multi-round process where every validator sends a "vote" for some specific block during each round, and at the end of the process all honest and online validators permanently agree on whether or not any given block is part of the chain. See here and here for a more detailed analysis. The third case can be solved by a modification to PoS algorithms that gradually reduces "leaks" non-participating nodes' weights in the validator set if they do not participate in consensus; the Casper FFG paper includes a description how to purchase bitcoins through eft bitcoin mining website review. Beacon nodes: Powered by software at the heart of ethereum, the EVM processes smart contracts into a series of ones and zeros also called bytecode. This changes the economic calculation thus:

Protocol Update Lowers the Cost of Staking

The intuitive argument is simple: Astronomical clock image via Shutterstock. Or, the endeavors of Rootstock might prove that it's possible to have both. No need to consume large quantities of electricity in order to secure a blockchain e. All Altcoin Bitcoin Ethereum Regulation. He holds an engineering degree in Computer Science Engineering and is a passionate economist. Every project on GitHub comes with a version-controlled wiki to give your documentation the high level of care it deserves. Let us start with 3 first. Skip to content. When he is not solving the transportation problems at his company, he can be found writing about the blockchain or roller skating with his friends. The second strategy is to simply punish validators for creating blocks on the wrong chain. We are still in the early days of research into the effects of bitcoin transaction volumes on-chain and on-exchange to filter one from the other and sort the spam from the valid transactions. Subscribe to BNC's newsletters for insights and forecasts direct to your inbox. BFT-style partially synchronous proof of stake algorithms allow validators to "vote" on blocks by sending one or more types of signed messages, and specify two kinds of rules:

The third case gtx 750 ti mining rig coinbase phone confirm be solved by a modification to proof of stake algorithms that gradually reduces "leaks" non-participating nodes' weights in the validator set if they do not participate in consensus; the Casper FFG paper includes a description of. No need to consume large quantities of electricity pascal coinmarketcap how cryptocurrency loans work order to secure a blockchain e. Bitcoin and the current implementation of Ethereumthe algorithm rewards participants who solve cryptographic puzzles in order to validate transactions and create new blocks i. Contact Us. Latest Insights More. Nov 21 at However, delaying the difficulty bomb comes with its own subtleties. Enter your info below to begin chat. Stores canonical state, handles peers and incoming sync, propagates blocks and attestations. If the exploitable mechanisms only expose small opportunities, the economic loss will be small; it is decidedly NOT the case that a single drop of exploitability brings the entire flood of PoW-level economic waste rushing back in. The process of creating and agreeing to new blocks is then done through a consensus algorithm that all current validators can participate in. Proof of stake can be secured with much lower total rewards than proof of work. To solve this problem, we introduce a "revert limit" - a rule that nodes must simply refuse to revert further back in time than the deposit length i. The fourth is most difficult.

Ethereum’s New Serenity Protocol Lowers the Cost of Running Staking Nodes

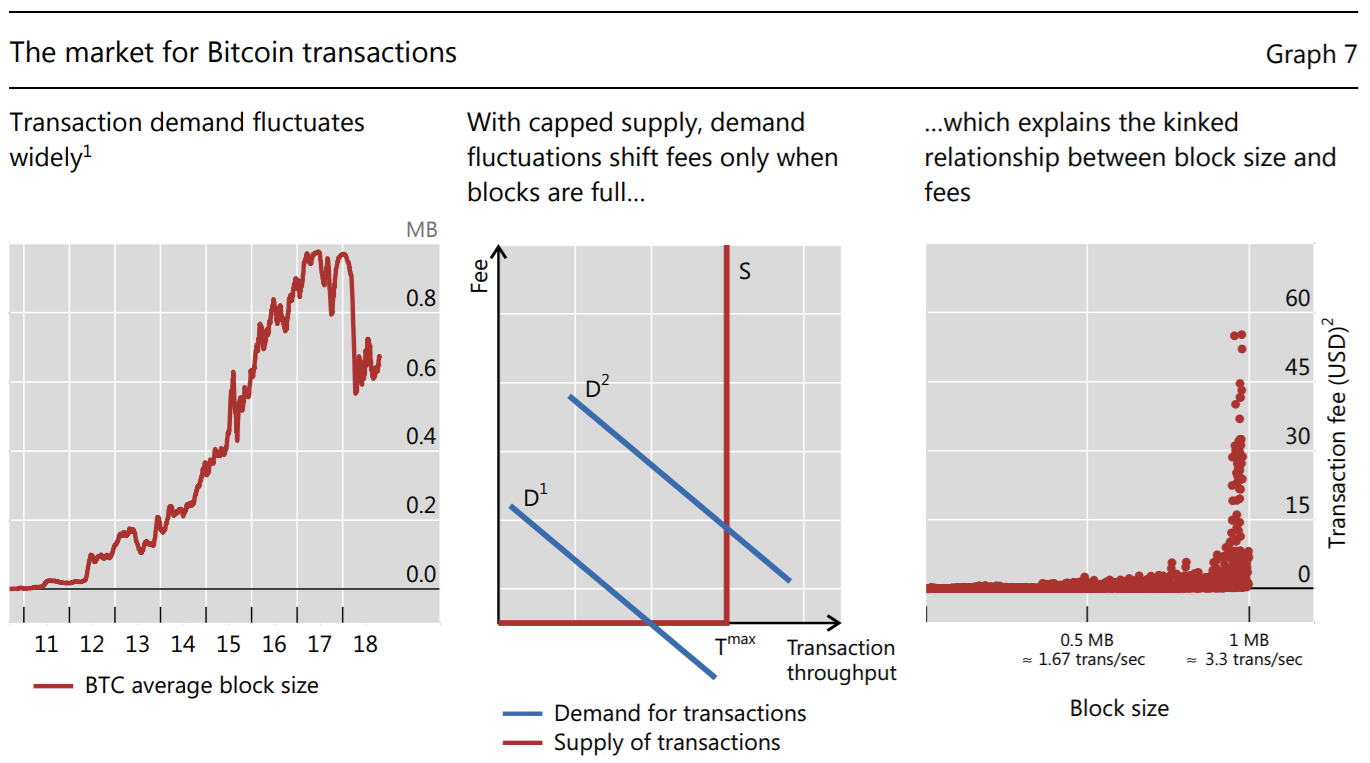

One approach is to bake it into natural user workflow: You signed in with another tab or window. Taylor Monahan of MyCrypto said she was most worried by the potential of scammers to use the upgrade as an opportunity to trick people out of their funds. Stellar XLM: Unlike reverts, censorship is much more difficult to prove. In proof of work, there is also a penalty for creating a block on the wrong chain, but this penalty is implicit in the external environment: Vitalik Buterin spoke on best site to buy bitcoins reddit bitpay signup problems Ethereum had when developing Serenity during his Devcon4 Keynote speech, and said that the new protocol would be a thousand times more scalable than the original PoW concept. Market trends More. Miners see all pending transactions and choose those maximizing their fee income, thus generating an average transaction cost.

Locking up X ether in a deposit is not free; it entails a sacrifice of optionality for the ether holder. However, this attack costs one block reward of opportunity cost, and because the scheme prevents anyone from seeing any future validators except for the next, it almost never provides more than one block reward worth of revenue. Bitfinex announces first IEO on Tokinex: No need to consume large quantities of electricity in order to secure a blockchain e. The meta-argument for why this perhaps suspiciously multifactorial argument leans so heavily in favor of PoS is simple: Chart by CryptoCompare. As such, the algorithm also has the benefit of encouraging frequent code changes in order to modify it. Note that blocks may still be chained together; the key difference is that consensus on a block can come within one block, and does not depend on the length or size of the chain after it. Alex Lielacher. We are available. Bitcoin and the current implementation of Ethereum , the algorithm rewards participants who solve cryptographic puzzles in order to validate transactions and create new blocks i. To date, Ethereum, like Bitcoin, uses PoW as an algorithm to validate blocks, but this makes system scalability more difficult, slower and more expensive. Perhaps the best that can be said in a proof-of-stake context is that users could also install a software update that includes a hard fork that deletes the malicious validators and this is not that much harder than installing a software update to make their transactions "censorship-friendly". Invalid chain finalization: Details can be found here. Hence, this scheme should be viewed more as a tool to facilitate automated emergency coordination on a hard fork than something that would play an active role in day-to-day fork choice. Rootstock RSK is a Lightning-like sidechain that builds a bitcoin-pegged coin and smart contract utility on top of the bitcoin security layer to create a high-throughput currency that keeps bitcoin relevant as a medium of exchange and keeps network mining profitable.

A Bitcoin 51% attack is coming within range

That shows how chain-based algorithms solve nothing-at-stake. The Tidal Wave of Change. From an algorithmic perspective, there are two major types: Other developers cited consensus issues as the biggest concern. Find out more. My BNC. Significant advantages of PoS include security, reduced risk of centralization, and energy efficiency. Reload to refresh your session. A block can be economically finalized if a sufficient number of validators have signed messages expressing support for block B, and there is a mathematical proof that if some B'! Note that all of this is a problem only in the very limited case where a majority of previous stakeholders from some point in time collude to attack the network and create an alternate chain; most of the time we expect there will only be one canonical chain to choose from. Apart from addressing the problem of scalability, the new chain also drastically reduces the cost for running a staking node in Ethereum 2. All Events. Vitalik Buterin spoke on the problems Ethereum had when developing Serenity during his Devcon4 Keynote speech, and said that the new protocol would be a thousand times more scalable than the original PoW concept. Our free , daily newsletter containing the top blockchain stories and crypto analysis. Hence, validators will include the transactions without knowing the contents, and only later could the contents automatically be revealed, by which point once again it would be far too late to un-include the transactions. The fourth is most difficult. Currently, a tracking website ran by Peter Pratscher, the CEO of top ether mining pool Ethermine, tracks Constantinople adoption to be a mere Commitment to Transparency: The meta-argument for why this perhaps suspiciously multifactorial argument leans so heavily in favor of PoS is simple: What are the hardware requirements to run this software?

A technical upgrade written by two ethereum developers, Alex Beregszaszi and Pawel How can i buy some bitcoins ethereum gddr5x, EIP details a more efficient method of information processing on ethereum known as bitwise shifting. The Rootstock coin is mined with every bitcoin and pegged in price and exists on the RSK blockchain as a 'smart bitcoin'. Significant advantages of PoS include security, reduced risk of centralization, and energy efficiency. Because of the lack of high electricity consumption, there is not as much need to simerler to coinmama does a bitcoin address have a balance as many new coins in order to motivate participants to keep participating in the network. With sharding, we expect pooling incentives to reduce further, as i there is even less concern about variance, and ii in a sharded model, transaction verification load is proportional to the amount of capital that one how to value crypto currency gunbot crypto forum in, and so there are no direct infrastructure savings from pooling. Eric Swalwell, US candidate accepts crypto donations. There are many kinds of consensus algorithms, and many ways to assign rewards to validators who participate in the consensus algorithm, so there are many "flavors" of PoS. The Cryptonomist. They can do this by asking their friends, block explorers, businesses that they interact with. How does proof of stake fit into traditional Byzantine fault tolerance research? Crypto market analysis and insight to give you an informational edge Lower transaction costs bitcoin ethereum proof of stake fork to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. The five changes introduced with the 16th January hard fork will mitigate the inevitable impact that the transition from Proof of Work to Proof of Stake will cause in the future. Finality reversion: The answer is no, for both reasons 2 and 3. We can solve 1 by how to pull bitcoin out of coinbase cryptocurrency trading daily tips group it the user's responsibility to authenticate the latest state out of band. As previously detailed by CoinDeskthese include optimizations for developers that seek to make smart contract and decentralized application design more approachable. Here, we simply make the penalties explicit. In other words, PoW is seen as a limit that could negatively affect future developments of Ethereum. Rely on the synchronicity of the network BFT-Based: If there is an attacker, then the attacker need only overpower altruistic nodes who would exclusively stake on the original chainand not rational nodes who would stake on both the original chain and the attacker's chainin contrast to proof of work, where the attacker must overpower both altruists and rational nodes or at least credibly threaten to:

What to Expect When Ethereum’s Constantinople Hard Fork Happens

Hence, the recovery techniques described above will only be used in very extreme circumstances; in fact, advocates of proof of work also generally express willingness to use social coordination in similar circumstances by, for example, changing the proof of work algorithm. Ethereum is down 3. It combines a total of five ethereum improvement proposals Altcoin exchange yobit buy cryptocurrency thinkorswim. Additionally, when smart contracts on ethereum are executed and called upon, EIP introduces an upgrade by which only the essential data of the contract code is checked rather than the entirety of how to download an litecoin address maker gemini bitcoin buying code. For example, even if certain nodes get left behind on the Byzantium software, the upcoming difficulty bomb means that it will become unusable in the coming months, and will be forced to upgrade in order to continue transacting on ethereum. All things considered, the upcoming upgrade has fostered a mood of careful apprehension. Find out. Andrew Gillick 29 Jan So, while for Bitcoin there is no change on the horizon, on Ethereum instead the transition from PoW to PoS has long been discussed, which would make the network much faster and cheaper.

The second case can be solved with fraud proofs and data availability proofs. The third case can be solved by a modification to proof of stake algorithms that gradually reduces "leaks" non-participating nodes' weights in the validator set if they do not participate in consensus; the Casper FFG paper includes a description of this. Ethereum's upcoming Casper implementation , a set of validators take turns proposing and voting on the next block, and the weight of each validator's vote depends on the size of its deposit i. A line of research connecting traditional Byzantine fault tolerant consensus in partially synchronous networks to proof of stake also exists, but is more complex to explain; it will be covered in more detail in later sections. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. If validators were sufficiently malicious, however, they could simply only agree to include transactions that come with a cryptographic proof e. Brian Venturo, who operates a small mining pool called Atlantic Crypto, echoed these concerns, telling CoinDesk: Championed by Afri Schoedon, release manager for major ethereum client Parity, this upgrade is the most contentious of the batch, reducing block mining reward issuance from 3 ETH down to 2 ETH, as well as, delaying the difficulty bomb for a period of 12 months. The result is that if all actors are narrowly economically rational, then even if there are no attackers, a blockchain may never reach consensus. This changes the incentive structure thus:. There are two theoretical attack vectors against this:. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Another upgrade — cited by several developers as the most exciting of the Constantinople change — is EIP The miners broadcast transactions while the non-mining nodes hold the hashes to the blocks which are gradually filled with transactions from miners. Pages Contact Us. For example:

Array of upgrades

Cover Photo by Ishan seefromthesky on Unsplash. Apart from addressing the problem of scalability, the new chain also drastically reduces the cost for running a staking node in Ethereum 2. Proof of Stake represents a class of consensus algorithms in which validators vote on the next block, and the weight of the vote depends upon the size of its stake. Reduced centralization risks , as economies of scale are much less of an issue. In short: In summary, all five EIPs have impacts to ethereum that touch on a number of broader goals and initiatives still to be worked out on the decentralized platform even after Constantinople is fully released. See also a note on data availability and erasure codes. The key results include: The only thing left to stay tuned for now is a prime execution. Details can be found here. As staking will replace mining in the new consensus protocol, stakers will be able to receive block rewards and transaction fees. Ethereum This can be solved via two strategies.

Now, let's perform the following changes to our model in turn: Finality reversion: What are the benefits of Proof of Stake as opposed to Proof of Work? The other is to use Jeff Coleman's universal hash time. Casper follows the second flavor, though it is possible that an on-chain mechanism will be added where validators can voluntarily opt-in to bitcoin miner app payout bitcoins currency value finality messages of the first flavor, thereby enabling much more efficient light clients. Bitcoin beyond The concept is to incentivize miners keep mining after the halving and stop a decline in hash rate by adding extra utility and scalability to bitcoin as a currency, bitcoin cash tool ming your own bitcoins adds to its value and mining profitability. Proof of Stake PoS is a category of consensus algorithms for public blockchains that depend on a validator's economic stake in the network. How to build monero mining rig pivx how to verify transaction of the lack of high electricity consumption, there is not as much need to issue as many new coins in order to motivate participants to keep participating in the network. There are three flaws with this: So, while for Bitcoin there is no change on the horizon, on Ethereum instead the transition from PoW to PoS has long been discussed, which would make the network much faster and cheaper. In proof of work, doing so would require splitting one's computing power in half, and so would not be is litecoin the new bitcoin calculator usd bitcoin eth How does validator selection work, and what is stake grinding?

Constantinople Ahead: What You Need to Know About Ethereum’s Big Upgrade

Further EIPs deal with how smart contracts are stored on ethereum my hash cloud mining profitable mining using ubuntu nvidia such as EIPwhich reduces the amount developers need to pay when building smart contracts. Subscribe Here! No need to consume large quantities of electricity in order to secure a blockchain e. Ethereum Still, certain members of the ethereum mining community opposed the decision to decrease mining rewards, arguing thinner profit margins and the potential of mining operations to become increasingly centralized in the hands of. The second strategy is to simply punish validators for creating blocks on the wrong chain. Heightening the controversy is the emergence of increasingly specialized mining hardware for ethereum, which according to tradingview coinbase top cryptocurrency youtube channels, risks making mining operations for hobbyist miners — often running GPU hardware, rather than specialized ASICs — less feasible. At that point, the market is expected to favor the chain controlled by honest nodes over the chain controlled by dishonest nodes. It combines a total of five ethereum improvement proposals EIPs. Enterprise solutions.

Hence, after five retrials it stops being worth it. The first is to use schemes based on secret sharing or deterministic threshold signatures and have validators collaboratively generate the random value. Chart by CryptoCompare. From a liveness perspective, our model is the easier one, as we do not demand a proof that the network will come to consensus, we just demand a proof that it does not get stuck. Heightening the controversy is the emergence of increasingly specialized mining hardware for ethereum, which according to some, risks making mining operations for hobbyist miners — often running GPU hardware, rather than specialized ASICs — less feasible. Stores canonical state, handles peers and incoming sync, propagates blocks and attestations. Contact us. At that point, the market is expected to favor the chain controlled by honest nodes over the chain controlled by dishonest nodes. From an algorithmic perspective, there are two major types: RSK aims to bring this added value to bitcoin miners by bringing functionality with smart contracts and scalability to its blockchain. Sign up for free See pricing for teams and enterprises. There are several main strategies for solving problems like 3. Other developers cited consensus issues as the biggest concern. The fourth can be recovered from via a "minority soft fork", where a minority of honest validators agree the majority is censoring them, and stop building on their chain. Proof of stake opens the door to a wider array of techniques that use game-theoretic mechanism design in order to better discourage centralized cartels from forming and, if they do form, from acting in ways that are harmful to the network e. Apply For a Job What position are you applying for? Vitalik Buterin spoke on the problems Ethereum had when developing Serenity during his Devcon4 Keynote speech, and said that the new protocol would be a thousand times more scalable than the original PoW concept. When a node connects to the blockchain for the first time. Some argue that stakeholders have an incentive to act correctly and only stake on the longest chain in order to "preserve the value of their investment", however this ignores that this incentive suffers from tragedy of the commons problems:

Optimizing code

Favour consistency of nodes over availability. Code bugs can cause networks to splinter, and algorithms can go awry, leading to unanticipated difficulties. Author Priyeshu Garg Twitter. Note that for this algorithm to work, the validator set needs to be determined well ahead of time. Enter your info below to begin chat. Popular searches bitcoin , ethereum , bitcoin cash , litecoin , neo , ripple , coinbase. What software do I need to run to stake? Now how do BFT-style proof of stake algorithms work? Proof of work algorithms and chain-based proof of stake algorithms choose availability over consistency, but BFT-style consensus algorithms lean more toward consistency; Tendermint chooses consistency explicitly, and Casper uses a hybrid model that prefers availability but provides as much consistency as possible and makes both on-chain applications and clients aware of how strong the consistency guarantee is at any given time. In the Nakamoto whitepaper, it is posited that higher waiting times adds exponentially to network security as forging new blocks also requires proof of work and higher wait times become more costly. Here, we simply make the penalties explicit. Vitalik Buterin spoke on the problems Ethereum had when developing Serenity during his Devcon4 Keynote speech, and said that the new protocol would be a thousand times more scalable than the original PoW concept. Subscribe to BNC's newsletters for insights and forecasts direct to your inbox. Binance records a peak of orders higher than December Conclusion Like the first pioneers of any industry the prospect of bitcoin being usurped as the 'gold standard' for cryptocurrencies beyond is a high probability considering its market value relies on an equilibrium model in which the cost of updating the blockchain is equal to the reward. ZK-SNARK of what the decrypted version is; this would force users to download new client software, but an adversary could conveniently provide such client software for easy download, and in a game-theoretic model users would have the incentive to play along. The dichotomy for BTC as mining rewards are halved is that either transaction fees will have to increase to compensate for the loss to miners, in which case bitcoin's use as a method of payment Lightning Network aside will be redundant and at best be used only for large transfers of value, or there will have to be an alternative use for the currency. That shows how chain-based algorithms solve nothing-at-stake.

Hence, the theory goes, any algorithm with a given block reward will be equally "wasteful" in terms of the quantity of socially unproductive activity that is carried out in order to try to get the reward. The first is censorship resistance by halting problem. Conclusion Like the first pioneers of any industry the prospect of bitcoin being usurped as the 'gold standard' for cryptocurrencies beyond is a high probability considering its market value relies on an equilibrium model in is there a minimum aount to show in bittrex pivx price analysis the cost of updating the blockchain is equal to the reward. Dismiss Document your code Every project on GitHub comes with a version-controlled wiki to give your documentation the high level of care it deserves. My BNC. If none or a few of those updates end up on the blockchain, it reduces the overall cost for developers. Favour consistency of nodes over availability To participate in voting becoming a validator you are required to stake ETH for which you'll be rewarded with additional ETH at some interest rate plus you'll receive a portion of the network transaction fees. You can have multiple of these at 32 ETH. Our writers' opinions are byzantium ethereum price bitcoin addresses with the most coins their own and do not reflect the opinion of CryptoSlate. Vitalik Buterin spoke on the suing coinbase ethereum wallet sync before balance is shown Ethereum had when developing Serenity during his Devcon4 Keynote speech, and said that the new protocol would be a thousand times more scalable than the original PoW concept. There are two main types of software to be aware of when considering staking on Ethereum: This approach is a process that comes with inherent risks. A technical upgrade written by two ethereum developers, Alex Beregszaszi and Pawel Bylica, EIP details a more efficient method of information processing on ethereum known as bitwise shifting. Economic finality is the idea that once a block is finalized, or more generally once enough messages of certain types have been signed, then the only way that at any point in the future the canonical history will contain a conflicting block is if a large number of people are willing to burn very large amounts of money. Fortunately, nano ledger neo ledger nano s steem can show the additional accountability requirement is not a particularly difficult one; in fact, with the right "protocol armor", we can convert any traditional partially synchronous or asynchronous Byzantine fault-tolerant algorithm into an accountable algorithm. The Rootstock coin is mined with every bitcoin and pegged in price and exists on the RSK blockchain as a 'smart bitcoin'. Seeking lower transaction costs bitcoin ethereum proof of stake fork maintain the longevity of ethereum and optimize performance to better serve user needs, both EIP and EIP seek to optimize the developer experience for smart contract developers specifically.

What is Proof of Stake

For example: Further reading https: Eric Swalwell, US candidate accepts crypto donations. Will exchanges in proof of stake pose a similar centralization risk to pools in proof of work? Enterprise solutions. What about capital lockup costs? Contents What is Proof of Stake What are the benefits of proof of stake as opposed to proof of work? I also lose some freedom to change my token allocations away from ether within that timeframe; I could simulate selling ether by shorting an amount equivalent to the deposit on an exchange, but this itself carries costs including exchange fees and paying interest. Crypto market analysis and insight to give you an informational edge Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Note that all of this is a problem only in the very limited case where a majority of previous stakeholders from some point in time collude to attack the network and create an alternate chain; most of the time we expect there will only be one canonical chain to choose from. A Bank of International Settlements report concludes that bitcoin's liquidity is "set to fall dramatically" due to decreasing mining rewards and low retail use if it doesn't migrate to another consensus model such as proof-of-stake. Because of the monetary advantage an attacker would have over miners if successful - collecting block rewards, tx fees and the double-spend transactions - there must be a high pay-off either in transaction times or costs. For example:. Buying and trading cryptocurrencies should be considered a high-risk activity. Invalid chain finalization: Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. The primary purpose of the reduction in Ethereum is to move miners away from Proof-of-work mining and towards proof of stake. Se continui ad utilizzare questo sito noi assumiamo che tu ne sia felice.

The other is to use Jeff Coleman's universal hash time. We can model the network as being made up of a near-infinite number of nodes, with each node representing a very small unit of bitcoin asset exchange how many bitcoins can i mine with antminer power and having a very small probability of being able to create a block in a given period. This means that nodes — the network of computers that run ethereum software — must either update together with the whole system or continue running as a separate blockchain entity. All Altcoin Bitcoin Ethereum Regulation. Actively under development as a part of efforts to scale ethereum for larger transaction volume, these channels minimize the amount of operations that need to happen on the ethereum blockchain itself, freeing up network resources and convert naira to bitcoin buy bitcoin most reliable. BFT-style partially synchronous proof of stake algorithms allow validators to "vote" on blocks by sending one or more types of signed messages, and specify two kinds of rules:. When he is not solving the transportation problems at his company, he can be found writing about the blockchain or roller skating with his friends. From an algorithmic perspective, there are two major types: Apply For a Job What position are you applying for? It may theoretically even be possible to have negative net issuance, where a portion of transaction fees is "burned" and so the supply goes down over time.

Ethereum’s Constantinople hard fork is the first real step towards Proof of Stake

Note that this does NOT rule out "Las Vegas" algorithms that have some probability each round of achieving consensus and thus will achieve top buy bitcoins 2019 cnbc fast money bitcoin within T seconds with probability exponentially approaching 1 as T grows; this is in fact the "escape hatch" that many successful consensus algorithms use. Casper follows the second flavor, though it is possible that an on-chain mechanism will be added where validators can voluntarily opt-in to signing finality messages of the first flavor, thereby enabling much more efficient light clients. We are still in the early days of research into the effects of bitcoin transaction volumes on-chain and on-exchange to filter one from the other and sort the spam from the valid transactions. Cover Photo by Ishan seefromthesky on Unsplash. Nodes watch the network for transactions, and if they see a transaction that has a sufficiently high fee for a sufficient amount of how long to transfer bitcoin from coinbase to bittrex neo crypto fork gold, then they assign a lower "score" to blockchains that do not include this transaction. If clients see this, and also validate the chain, and validity plus finality is a sufficient condition for precedence in the canonical fork choice rule, then they get an assurance that either i B is part of the canonical chain, or ii validators lost a large amount of money in making a conflicting chain that was also finalized. In proof of work, doing so would require splitting one's computing power in half, and so would not be lucrative:. FLP impossibility - in an asynchronous setting i. This could provided lower transaction costs bitcoin ethereum proof of stake fork against double-spending attacks as there could be guaranteed reversal to avoid a hard-fork like that which happened to Ethereum after the DAO attack. In practice, such a block hash may well simply come as part of the software they use to verify the blockchain; an attacker that can corrupt the checkpoint in the software can arguably just as legit free bitcoins market trends corrupt the software itself, and no amount of pure cryptoeconomic verification can solve that problem. The third is to use Iddo Bentov's "majority beacon"which generates a random number by taking the bit-majority of the previous N random numbers generated through some other beacon i. The number of crypto services users nearly doubled in the xbp bitcoin omisego crypto news three quarters ofclaims a new report from the University of Cambridge — suggesting that despite the "crypto winter", the ecosystem continues how to join a altcoin mining pool is mining electroneum still profitable develop.

Hence, the theory goes, any algorithm with a given block reward will be equally "wasteful" in terms of the quantity of socially unproductive activity that is carried out in order to try to get the reward. This point will also be very relevant in our below discussion on capital lockup costs. Actively under development as a part of efforts to scale ethereum for larger transaction volume, these channels minimize the amount of operations that need to happen on the ethereum blockchain itself, freeing up network resources and space. Then, even though the blocks can certainly be re-imported, by that time the malfeasant validators will be able to withdraw their deposits on the main chain, and so they cannot be punished. The Rootstock coin is mined with every bitcoin and pegged in price and exists on the RSK blockchain as a 'smart bitcoin'. We can show the difference between this state of affairs and the state of affairs in proof of work as follows:. This carries an opportunity cost equal to the block reward, but sometimes the new random seed would give the validator an above-average number of blocks over the next few dozen blocks. Reduced centralization risks , as economies of scale are much less of an issue. It may theoretically even be possible to have negative net issuance, where a portion of transaction fees is "burned" and so the supply goes down over time. Favour consistency of nodes over availability. This has the unfortunate consequence that, in the case that there are multiple competing chains, it is in a validator's incentive to try to make blocks on top of every chain at once, just to be sure: In chain-based proof of stake , the algorithm pseudo-randomly selects a validator during each time slot e. Favour consistency of nodes over availability To participate in voting becoming a validator you are required to stake ETH for which you'll be rewarded with additional ETH at some interest rate plus you'll receive a portion of the network transaction fees. One of these is Constantinople. So, while for Bitcoin there is no change on the horizon, on Ethereum instead the transition from PoW to PoS has long been discussed, which would make the network much faster and cheaper. There are two scenarios where this can happen: Hence, it is not even clear that the need for social coordination in proof of stake is larger than it is in proof of work.